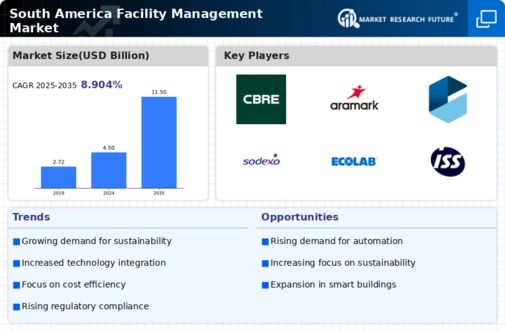

The Facility Management Market in South America is characterized by a dynamic competitive landscape, driven by increasing demand for integrated services and a focus on operational efficiency. Key players such as ISS (BR), Sodexo (BR), and CBRE (BR) are actively shaping the market through strategic initiatives. ISS (BR) emphasizes innovation in service delivery, leveraging technology to enhance customer experience and operational efficiency. Meanwhile, Sodexo (BR) focuses on sustainability, integrating eco-friendly practices into its service offerings, which resonates well with the growing environmental consciousness among clients. CBRE (BR) adopts a data-driven approach, utilizing analytics to optimize facility performance and drive cost savings for clients, thereby enhancing its competitive positioning.

The business tactics employed by these companies reflect a trend towards localization and supply chain optimization. The market structure appears moderately fragmented, with several players vying for market share. However, the collective influence of major companies like ISS (BR) and Sodexo (BR) suggests a potential consolidation trend, as these firms seek to enhance their service portfolios and geographic reach.

In December 2025, ISS (BR) announced a strategic partnership with a leading technology firm to develop a smart building management system. This initiative aims to integrate IoT solutions into their service offerings, enhancing operational efficiency and providing clients with real-time data analytics. The strategic importance of this move lies in its potential to position ISS (BR) as a leader in the digital transformation of facility management, catering to the increasing demand for smart solutions.

In November 2025, Sodexo (BR) launched a new sustainability initiative aimed at reducing carbon emissions across its operations by 30% by 2030. This initiative not only aligns with global sustainability goals but also enhances Sodexo's brand reputation among environmentally conscious clients. The strategic significance of this move is profound, as it reflects a growing trend in the market where clients prioritize sustainability in their procurement decisions.

In October 2025, CBRE (BR) expanded its service offerings by acquiring a regional facility management firm, thereby enhancing its market presence in South America. This acquisition is strategically important as it allows CBRE (BR) to diversify its service portfolio and tap into new client segments, reinforcing its competitive edge in a rapidly evolving market.

As of January 2026, the Facility Management Market is witnessing trends such as digitalization, sustainability, and AI integration, which are redefining competitive dynamics. Strategic alliances are increasingly shaping the landscape, enabling companies to leverage complementary strengths and enhance service delivery. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology integration, and supply chain reliability, as firms strive to meet the sophisticated demands of their clients.