Rising Incidence of Infertility

The rising incidence of infertility in South America serves as a significant driver for the fertility drug-surgery market. Factors such as lifestyle changes, environmental influences, and delayed childbearing contribute to this trend. Recent studies indicate that infertility affects around 15% of couples in the region, prompting an increased demand for fertility treatments. As more individuals and couples face challenges in conceiving, the market for fertility drugs and surgical options is likely to expand. This growing prevalence of infertility underscores the necessity for innovative solutions and comprehensive care, thereby propelling the fertility drug-surgery market forward.

Advancements in Medical Technology

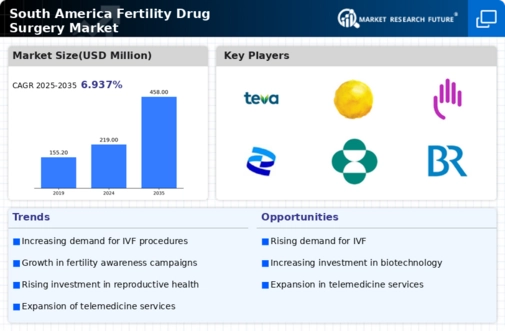

Advancements in medical technology are transforming the fertility drug-surgery market in South America. Innovations such as in vitro fertilization (IVF) techniques, preimplantation genetic testing, and minimally invasive surgical procedures have improved success rates and patient experiences. The introduction of new fertility drugs, which are more effective and have fewer side effects, is also noteworthy. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. These technological advancements not only enhance treatment outcomes but also attract more patients seeking effective solutions for their fertility challenges.

Government Initiatives and Support

Government initiatives and support play a pivotal role in shaping the fertility drug-surgery market in South America. Various countries in the region are implementing policies aimed at improving access to fertility treatments, including subsidies and funding for assisted reproductive technologies. For instance, some governments have introduced programs that cover a portion of the costs associated with fertility treatments, making them more accessible to a broader population. This support is likely to stimulate market growth, as financial barriers are reduced, encouraging more individuals to pursue fertility interventions. The proactive stance of governments in addressing reproductive health issues is expected to have a lasting impact on the industry.

Cultural Shifts Towards Family Planning

Cultural shifts towards family planning and reproductive health are influencing the fertility drug-surgery market in South America. As societal norms evolve, there is a growing acceptance of fertility treatments, which were once stigmatized. This change is particularly evident among younger generations who prioritize family planning and are more open to seeking medical assistance for fertility issues. The fertility drug-surgery market is likely to benefit from this cultural transformation, as more individuals view fertility treatments as viable options. This shift not only increases demand but also encourages healthcare providers to offer a wider range of services tailored to the needs of diverse populations.

Increasing Awareness of Fertility Issues

The growing awareness of fertility issues among the population in South America is a crucial driver for the fertility drug-surgery market. Educational campaigns and media coverage have contributed to a heightened understanding of reproductive health, leading to more individuals seeking assistance. This trend is reflected in the increasing number of consultations with fertility specialists, which has risen by approximately 30% over the past five years. As more people recognize the importance of addressing fertility challenges, the demand for both fertility drugs and surgical interventions is expected to grow. This shift in perception is likely to enhance the overall market landscape, as individuals become more proactive in seeking solutions to their reproductive health concerns.