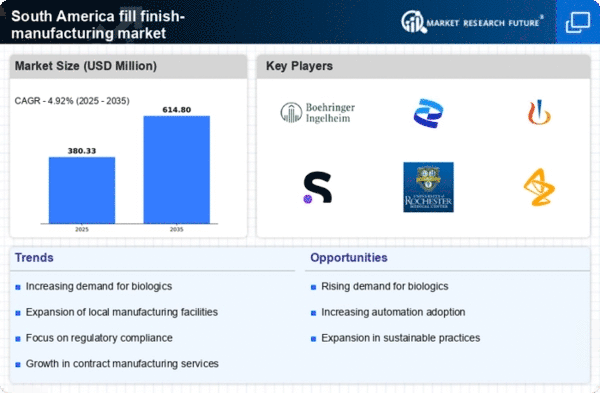

Focus on Sustainable Practices

Sustainability is becoming a focal point for the fill finish-manufacturing market in South America. Companies are increasingly adopting eco-friendly practices to minimize their environmental footprint. This includes the use of sustainable materials and energy-efficient production processes. The market is witnessing a shift towards biodegradable packaging and waste reduction strategies, which not only appeal to environmentally conscious consumers but also align with regulatory expectations. The fill finish-manufacturing market is likely to benefit from this trend, as companies that prioritize sustainability may enhance their brand reputation and attract new customers, ultimately driving growth.

Increasing Regulatory Scrutiny

The fill finish-manufacturing market in South America is experiencing heightened regulatory scrutiny, which serves as a double-edged sword. On one hand, stringent regulations ensure product safety and efficacy, fostering consumer trust. On the other hand, compliance can impose significant operational challenges for manufacturers. The industry is adapting by investing in quality assurance systems and training programs to meet these regulatory demands. As a result, companies that excel in compliance are likely to gain a competitive edge in the fill finish-manufacturing market. This trend indicates a shift towards more robust quality management practices, which could enhance overall market integrity.

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals in South America is a key driver for the fill finish-manufacturing market. As the healthcare sector expands, the need for advanced drug formulations and delivery systems grows. This trend is evidenced by a projected growth rate of 8% annually in the biopharmaceutical sector, which directly influences the fill finish-manufacturing market. Companies are investing in state-of-the-art facilities to meet this demand, ensuring that products are filled and finished under stringent conditions. The fill finish-manufacturing market is adapting to these needs by enhancing production capabilities and ensuring compliance with international standards, thereby facilitating the introduction of innovative therapies.

Technological Advancements in Production

Technological advancements are transforming the fill finish-manufacturing market in South America. The integration of cutting-edge technologies such as robotics and artificial intelligence is streamlining production processes, enhancing efficiency, and reducing human error. For instance, automated filling systems can increase throughput by up to 30%, which is crucial for meeting the rising demand for pharmaceuticals. Furthermore, these technologies enable better tracking and traceability of products, which is essential for regulatory compliance. As the fill finish-manufacturing market embraces these innovations, it is likely to see improved product quality and reduced operational costs, positioning companies for competitive advantage.

Growth of Contract Manufacturing Organizations (CMOs)

The rise of Contract Manufacturing Organizations (CMOs) in South America is significantly impacting the fill finish-manufacturing market. CMOs offer specialized services that allow pharmaceutical companies to outsource their production needs, thereby reducing capital expenditures. This trend is particularly relevant as many companies seek to focus on core competencies such as research and development. The fill finish-manufacturing market is witnessing a shift towards partnerships with CMOs, which can provide flexible and scalable solutions. This collaboration is expected to grow, with CMOs projected to capture a larger share of the market, driven by their ability to meet diverse client needs efficiently.