Rising Demand for Biopharmaceuticals

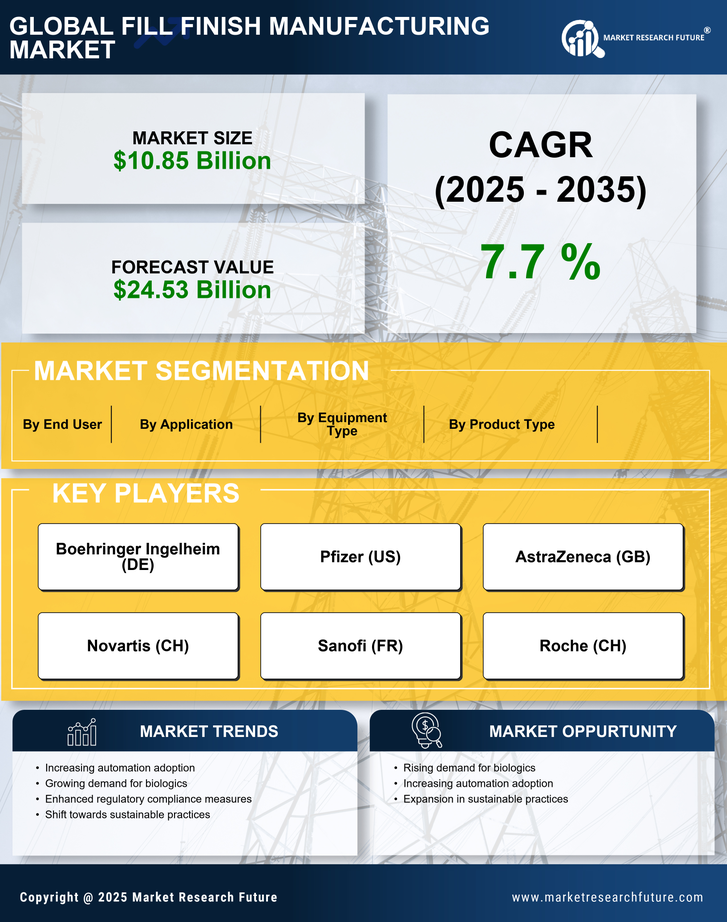

The Fill Finish Manufacturing Market is experiencing a notable surge in demand for biopharmaceuticals, driven by the increasing prevalence of chronic diseases and the need for innovative therapies. As biopharmaceuticals often require complex fill finish processes, manufacturers are investing in advanced technologies to enhance production efficiency. According to recent data, the biopharmaceutical sector is projected to grow at a compound annual growth rate of over 8% in the coming years. This growth necessitates robust fill finish capabilities to ensure product integrity and compliance with stringent regulatory standards. Consequently, companies within the Fill Finish Manufacturing Market are likely to expand their facilities and adopt state-of-the-art equipment to meet this escalating demand.

Regulatory Compliance and Quality Assurance

Regulatory compliance remains a critical driver for the Fill Finish Manufacturing Market, as stringent guidelines from health authorities necessitate rigorous quality assurance measures. Manufacturers are compelled to adhere to Good Manufacturing Practices (GMP) and other regulatory standards to ensure the safety and efficacy of pharmaceutical products. The increasing complexity of regulatory requirements has led to a heightened focus on quality control processes within the fill finish operations. Data indicates that companies investing in comprehensive quality management systems can reduce product recalls and enhance customer trust. As regulatory scrutiny intensifies, the Fill Finish Manufacturing Market must prioritize compliance to maintain market access and uphold product integrity.

Increasing Focus on Sustainability Practices

Sustainability practices are becoming increasingly important within the Fill Finish Manufacturing Market, as stakeholders demand environmentally responsible manufacturing processes. Companies are exploring ways to minimize waste, reduce energy consumption, and utilize sustainable materials in their operations. The implementation of green technologies and practices not only aligns with regulatory expectations but also enhances brand reputation among consumers. Data indicates that organizations adopting sustainable practices can achieve cost savings of up to 20% in operational expenses. As the emphasis on sustainability continues to grow, the Fill Finish Manufacturing Market is likely to witness a shift towards more eco-friendly manufacturing solutions, which could redefine industry standards.

Technological Advancements in Fill Finish Processes

Technological advancements are significantly shaping the Fill Finish Manufacturing Market, as innovations in automation, robotics, and data analytics enhance production capabilities. The integration of advanced technologies allows for improved precision and efficiency in the fill finish processes, reducing the risk of contamination and ensuring product quality. For instance, the adoption of automated filling systems has been shown to increase throughput by up to 30%, thereby meeting the rising demand for high-volume production. Furthermore, the implementation of real-time monitoring systems enables manufacturers to maintain compliance with regulatory requirements, which is crucial in the highly regulated pharmaceutical sector. As these technologies continue to evolve, they are expected to play a pivotal role in the future of the Fill Finish Manufacturing Market.

Growth of Contract Manufacturing Organizations (CMOs)

The rise of Contract Manufacturing Organizations (CMOs) is significantly influencing the Fill Finish Manufacturing Market, as pharmaceutical companies increasingly outsource their fill finish operations to specialized providers. This trend is driven by the need for cost efficiency, flexibility, and access to advanced technologies that CMOs offer. Recent statistics suggest that the CMO market is expected to grow at a rate of approximately 10% annually, reflecting the growing reliance on external partners for manufacturing capabilities. By leveraging the expertise of CMOs, pharmaceutical companies can focus on their core competencies while ensuring high-quality fill finish processes. This shift is likely to reshape the competitive landscape of the Fill Finish Manufacturing Market in the coming years.