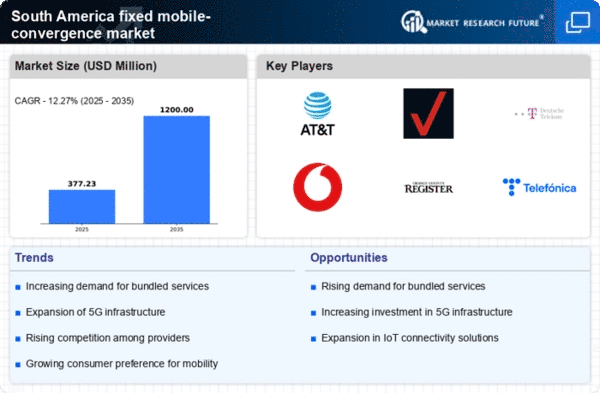

Expansion of 5G Infrastructure

The ongoing expansion of 5G infrastructure across South America is a pivotal driver for the fixed mobile-convergence market. With investments exceeding $10 billion in 2025, telecommunications companies are rapidly deploying 5G networks to enhance connectivity and support advanced applications. This technological advancement not only improves mobile broadband speeds but also facilitates the integration of fixed and mobile services, allowing for innovative solutions such as smart homes and IoT applications. As 5G becomes more prevalent, the demand for converged services is expected to rise, as consumers and businesses alike seek to leverage the enhanced capabilities offered by this next-generation technology. The fixed mobile-convergence market stands to gain significantly from this infrastructure development, as it enables more robust and versatile service offerings.

Rising Mobile Data Consumption

The fixed mobile-convergence market in South America is experiencing a surge in mobile data consumption, driven by the increasing reliance on mobile devices for internet access. As of 2025, mobile data traffic in the region is projected to grow by approximately 50% annually, reflecting a shift in consumer behavior towards mobile-first solutions. This trend is compelling service providers to enhance their offerings, integrating fixed and mobile services to meet the demand for seamless connectivity. The convergence of these services allows for more efficient data management and improved user experiences, which are crucial in a competitive landscape. Consequently, the fixed mobile-convergence market is likely to benefit from this rising demand, as consumers seek comprehensive solutions that combine the advantages of both fixed and mobile networks.

Government Initiatives for Digital Inclusion

Government initiatives aimed at promoting digital inclusion are playing a crucial role in shaping the fixed mobile-convergence market in South America. With a focus on expanding internet access to underserved areas, these initiatives are driving investments in telecommunications infrastructure. As of 2025, various governments have allocated substantial budgets, estimated at $5 billion, to enhance connectivity in rural and remote regions. This push for digital inclusion not only increases the potential customer base for service providers but also encourages the development of converged services that cater to diverse user needs. By fostering an environment conducive to growth, these government efforts are likely to stimulate the fixed mobile-convergence market, enabling more consumers to benefit from integrated service offerings.

Consumer Preference for Seamless Connectivity

Consumer preferences are shifting towards seamless connectivity, which is significantly influencing the fixed mobile-convergence market in South America. As users increasingly demand uninterrupted access to services across devices, service providers are compelled to offer integrated solutions that combine fixed and mobile services. In 2025, surveys indicate that approximately 70% of consumers prioritize seamless connectivity in their service choices, highlighting the importance of a unified experience. This trend is driving innovation within the market, as companies explore new technologies and service models to meet these expectations. The fixed mobile-convergence market is thus positioned to thrive, as it aligns with the growing consumer desire for cohesive and efficient communication solutions.

Increased Competition Among Service Providers

The competitive landscape in South America's telecommunications sector is intensifying, prompting service providers to innovate and differentiate their offerings. The fixed mobile-convergence market is particularly affected by this competition, as companies strive to attract and retain customers through bundled services and enhanced user experiences. In 2025, it is estimated that over 60% of consumers will prefer service bundles that combine fixed and mobile offerings, reflecting a shift in consumer preferences. This competitive pressure encourages providers to invest in technology and infrastructure, ultimately benefiting the market as a whole. As companies seek to capture market share, the fixed mobile-convergence market is likely to see an influx of new and improved service options, catering to the evolving needs of consumers.