Growing Demand in Electronics

The demand for graphene in the electronics sector is a significant driver for the graphene market in South America. With the rise of smart devices and the Internet of Things (IoT), the need for advanced materials that enhance performance is critical. Graphene's exceptional electrical conductivity and flexibility make it an ideal candidate for next-generation electronic components. The market for graphene-based electronics is expected to reach $1 billion by 2027, indicating a robust growth trajectory. Companies in South America are increasingly investing in research to develop graphene-based transistors, sensors, and flexible displays, which could revolutionize the electronics industry. This growing demand is likely to stimulate further innovation and collaboration within the graphene market.

Rising Awareness of Graphene Benefits

There is a growing awareness of the benefits of graphene among industries in South America, which is driving the graphene market. As companies become more informed about graphene's unique properties, such as its strength, conductivity, and thermal properties, they are increasingly considering its integration into their products. This awareness is particularly evident in sectors like automotive, aerospace, and construction, where the demand for lightweight and durable materials is rising. The potential for graphene to enhance product performance is likely to lead to increased adoption across various applications. As awareness continues to grow, the graphene market is expected to expand, with more companies exploring the possibilities of this remarkable material.

Technological Advancements in Production

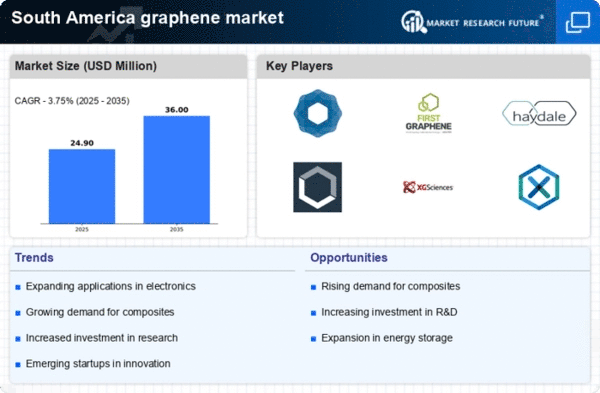

The graphene market in South America is experiencing a surge due to advancements in production technologies. Innovations such as chemical vapor deposition and liquid-phase exfoliation are enhancing the quality and scalability of graphene production. These methods are reducing costs and increasing the availability of high-purity graphene, which is crucial for various applications. As a result, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is driven by the increasing demand for graphene in electronics, energy storage, and composite materials. The ability to produce graphene at a lower cost while maintaining quality is likely to attract more investments, further propelling the graphene market in the region.

Expansion of Renewable Energy Applications

The shift towards renewable energy sources is significantly impacting the graphene market in South America. Graphene's unique properties, such as high conductivity and surface area, make it an attractive material for energy storage solutions, particularly in batteries and supercapacitors. As countries in South America aim to increase their renewable energy capacity, the integration of graphene into energy storage systems is becoming more prevalent. The market for graphene in energy applications is projected to grow by 30% annually, driven by the need for efficient energy storage solutions. This trend not only supports the transition to sustainable energy but also enhances the overall performance of energy systems, thereby boosting the graphene market in the region.

Increased Collaboration Between Academia and Industry

The graphene market in South America is benefiting from increased collaboration between academic institutions and industry players. Research institutions are focusing on the development of innovative graphene applications, while companies are eager to commercialize these findings. This synergy is fostering a vibrant ecosystem for graphene research and development. For instance, partnerships are emerging to explore graphene's potential in biomedical applications, which could open new revenue streams. The collaborative efforts are likely to enhance the competitiveness of the graphene market, as they facilitate knowledge transfer and accelerate the commercialization of new technologies. This trend is expected to contribute to a more robust market landscape in the coming years.