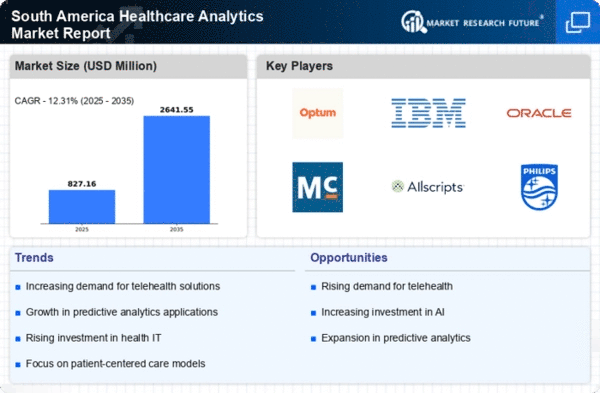

Expansion of Telehealth Services

The expansion of telehealth services is significantly impacting the healthcare analytics market in South America. As telehealth becomes more prevalent, the volume of data generated from virtual consultations and remote monitoring is increasing. This data can be analyzed to identify trends, improve service delivery, and enhance patient outcomes. The telehealth market is expected to grow by 30% annually, which will likely drive demand for analytics solutions that can effectively process and interpret this data. Consequently, healthcare organizations are increasingly recognizing the importance of integrating analytics into their telehealth strategies to optimize care delivery.

Growing Focus on Patient-Centric Care

The healthcare analytics market in South America is witnessing a growing focus on patient-centric care, which emphasizes the importance of tailoring healthcare services to individual patient needs. This shift is prompting healthcare organizations to invest in analytics solutions that can provide insights into patient preferences and behaviors. By utilizing data analytics, providers can enhance patient engagement and satisfaction, ultimately leading to better health outcomes. It is projected that the patient engagement segment within the healthcare analytics market will grow by 20% over the next few years, reflecting the increasing recognition of the value of personalized care.

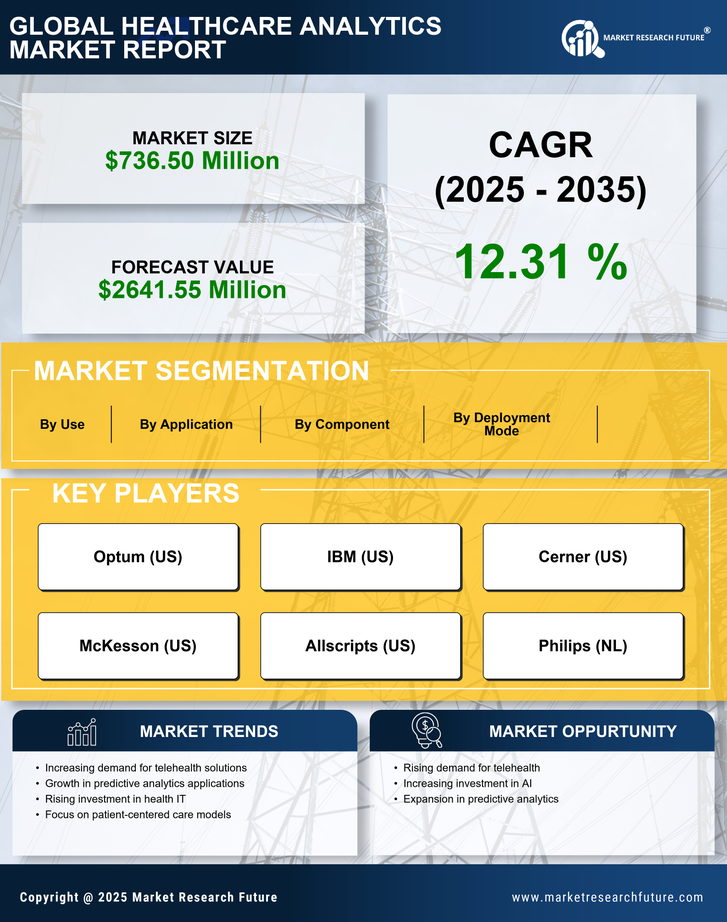

Rising Demand for Predictive Analytics

The healthcare analytics market in South America is experiencing a notable surge in demand for predictive analytics. This trend is driven by the need for healthcare providers to anticipate patient outcomes and optimize resource allocation. By leveraging predictive models, organizations can enhance decision-making processes, leading to improved patient care and operational efficiency. According to recent estimates, the predictive analytics segment is projected to grow at a CAGR of approximately 25% over the next five years. This growth reflects a broader shift towards data-driven strategies in the healthcare analytics market, as stakeholders seek to harness the power of data to drive better health outcomes.

Government Initiatives for Digital Health

Government initiatives aimed at promoting digital health solutions are playing a crucial role in shaping the healthcare analytics market in South America. Various countries in the region are implementing policies to enhance healthcare infrastructure and encourage the adoption of analytics tools. For instance, investments in health information systems and data analytics capabilities are expected to increase by 15% annually. These initiatives not only facilitate better data collection and analysis but also aim to improve healthcare delivery and patient outcomes. As governments prioritize digital health, the healthcare analytics market is likely to benefit from increased funding and support.

Integration of Wearable Health Technologies

The integration of wearable health technologies is significantly influencing the healthcare analytics market in South America. As consumers increasingly adopt devices that monitor health metrics, the volume of data generated is expanding rapidly. This influx of data presents opportunities for healthcare providers to analyze trends and improve patient engagement. It is estimated that the wearable technology market will reach a valuation of $30 billion by 2026, which will likely contribute to the growth of the healthcare analytics market. The ability to analyze real-time data from wearables can lead to more personalized care and proactive health management.