Rising Cyber Threats

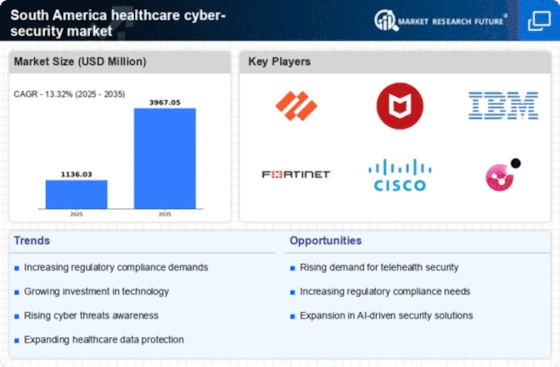

The healthcare cyber-security market in South America is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Reports indicate that healthcare organizations are prime targets for cybercriminals, with ransomware attacks and data breaches becoming alarmingly common. In 2025, it is estimated that cyber incidents in the healthcare sector could rise by over 30%, prompting organizations to invest heavily in advanced security measures. This trend underscores the urgent need for robust cyber-security solutions to protect sensitive patient data and maintain operational integrity. As a result, the healthcare cyber-security market is likely to see substantial growth as institutions prioritize safeguarding their digital assets against evolving threats.

Technological Advancements

The rapid evolution of technology is significantly influencing the healthcare cyber-security market in South America. Innovations such as artificial intelligence (AI) and machine learning (ML) are being integrated into security frameworks, enhancing threat detection and response capabilities. By 2025, it is projected that AI-driven solutions could account for approximately 25% of the market share, as they offer real-time analysis and predictive insights. Furthermore, the adoption of cloud computing and Internet of Things (IoT) devices in healthcare settings necessitates advanced security protocols to mitigate vulnerabilities. Consequently, the healthcare cyber-security market is poised for expansion as organizations leverage these technological advancements to fortify their defenses.

Increased Regulatory Scrutiny

The healthcare cyber-security market in South America is being shaped by a growing emphasis on regulatory compliance and data protection. Governments are implementing stricter regulations to safeguard patient information, compelling healthcare providers to enhance their cyber-security measures. For instance, compliance with data protection laws may require investments in advanced encryption and access control systems. As of 2025, it is anticipated that compliance-related expenditures could represent up to 20% of total cyber-security budgets in the healthcare sector. This regulatory landscape is driving organizations to prioritize cyber-security investments, thereby fostering growth within the healthcare cyber-security market.

Investment in Cyber Insurance

The healthcare cyber-security market in South America is witnessing a surge in interest towards cyber insurance as organizations seek to mitigate financial risks associated with cyber incidents. As cyber threats become more prevalent, healthcare providers are increasingly recognizing the importance of having insurance coverage to protect against potential losses. By 2025, it is projected that the market for cyber insurance in the healthcare sector could grow by over 40%, reflecting a shift in risk management strategies. This trend indicates that organizations are not only investing in preventive measures but are also looking to safeguard their financial stability in the event of a cyber breach, thereby contributing to the overall growth of the healthcare cyber-security market.

Growing Awareness of Cyber Risks

There is a notable increase in awareness regarding cyber risks among healthcare organizations in South America, which is positively impacting the healthcare cyber-security market. Stakeholders, including management and IT personnel, are recognizing the potential repercussions of cyber incidents, such as financial losses and reputational damage. This heightened awareness is leading to more proactive measures, including regular security assessments and employee training programs. By 2025, it is expected that organizations will allocate approximately 15% of their IT budgets to cyber-security training and awareness initiatives. This shift in mindset is likely to drive demand for comprehensive cyber-security solutions tailored to the unique needs of the healthcare sector.