Emergence of Telehealth Services

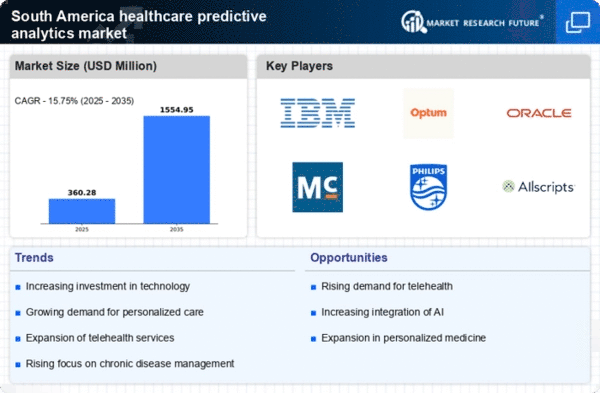

The emergence of telehealth services is reshaping the healthcare predictive-analytics market in South America. As telehealth becomes more prevalent, the volume of patient data generated through remote consultations increases, providing a rich source for predictive analytics. This trend is particularly relevant in rural areas where access to healthcare is limited. By analyzing telehealth data, healthcare providers can gain insights into patient behaviors and health trends, which can inform proactive care strategies. It is projected that telehealth services will grow by over 30% in the coming years, further driving the demand for predictive analytics solutions. This integration of telehealth and predictive analytics is likely to enhance patient care and operational efficiency in the healthcare predictive-analytics market.

Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a significant driver for the healthcare predictive-analytics market in South America. Governments and private entities are increasingly allocating funds to enhance healthcare facilities and technology, which includes the adoption of predictive analytics tools. This investment is crucial for improving healthcare delivery and ensuring that healthcare providers can leverage data effectively. Recent data suggests that healthcare spending in South America is expected to reach $500 billion by 2026, with a substantial portion directed towards technological advancements. As infrastructure improves, the capacity for implementing predictive analytics solutions expands, thereby fostering growth in the healthcare predictive-analytics market.

Growing Focus on Chronic Disease Management

Chronic disease management is becoming a focal point within the healthcare predictive-analytics market in South America. With the rising prevalence of chronic conditions such as diabetes and cardiovascular diseases, healthcare providers are increasingly turning to predictive analytics to manage these diseases effectively. By utilizing predictive models, healthcare organizations can identify high-risk patients and implement timely interventions, which is crucial for improving health outcomes. It is estimated that chronic diseases account for over 60% of healthcare expenditures in the region, highlighting the need for efficient management strategies. This growing emphasis on chronic disease management is likely to drive the demand for predictive analytics solutions, thereby enhancing the overall healthcare predictive-analytics market.

Rising Demand for Data-Driven Decision Making

The healthcare predictive-analytics market in South America is experiencing a notable surge in demand for data-driven decision-making processes. Healthcare providers are increasingly recognizing the value of leveraging data analytics to enhance patient outcomes and operational efficiency. This trend is underscored by a projected growth rate of approximately 25% in the adoption of predictive analytics tools over the next five years. As healthcare organizations strive to optimize resource allocation and improve patient care, the integration of predictive analytics into clinical workflows becomes essential. This shift not only aids in identifying at-risk populations but also facilitates personalized treatment plans, thereby driving the overall growth of the healthcare predictive-analytics market in the region.

Integration of Electronic Health Records (EHR)

The integration of Electronic Health Records (EHR) systems is a pivotal driver for the healthcare predictive-analytics market in South America. As healthcare institutions increasingly adopt EHR systems, the availability of comprehensive patient data enhances the capabilities of predictive analytics. This integration allows for more accurate forecasting of patient needs and trends, which is crucial for effective healthcare delivery. Reports indicate that around 70% of healthcare providers in South America are now utilizing EHR systems, which significantly contributes to the data pool available for predictive analytics. Consequently, this trend not only streamlines operations but also fosters a culture of data-driven decision-making, thereby propelling the growth of the healthcare predictive-analytics market in the region.