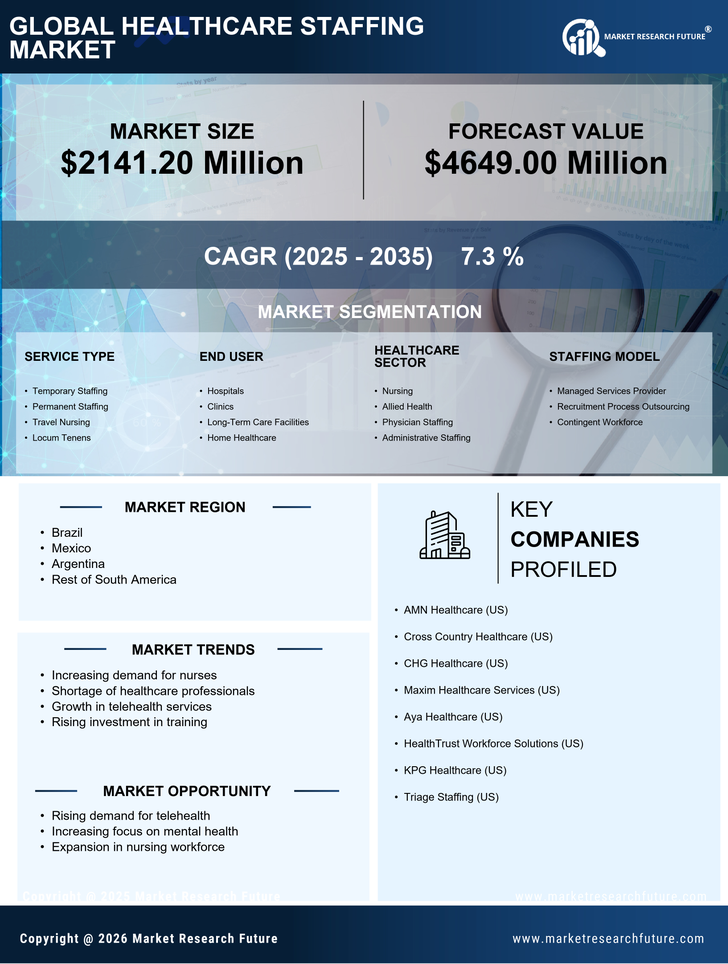

Rising Healthcare Expenditures

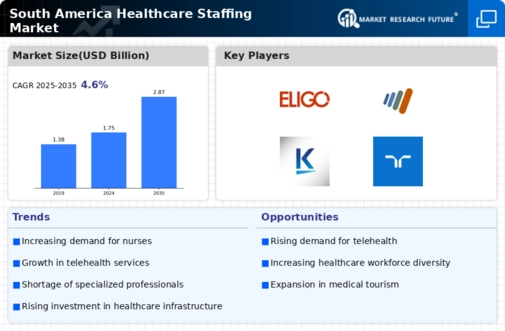

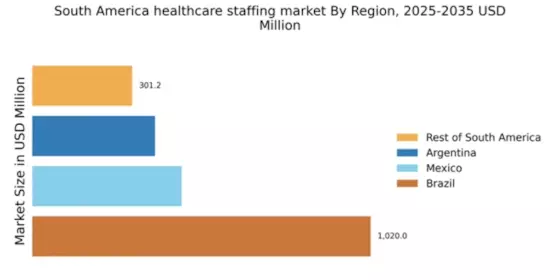

The healthcare staffing market in South America is experiencing growth due to rising healthcare expenditures. Governments and private sectors are increasing their investments in healthcare infrastructure, which necessitates a larger workforce. For instance, healthcare spending in countries like Brazil and Argentina has seen an increase of approximately 10% annually. This surge in funding is likely to create a demand for various healthcare professionals, including nurses, physicians, and allied health workers. As a result, the healthcare staffing market is poised to expand, with organizations seeking to fill positions to meet the growing needs of the population. The emphasis on improving healthcare services and accessibility further drives the demand for skilled professionals, indicating a robust future for the healthcare staffing market in the region.

Government Initiatives and Policies

Government initiatives aimed at improving healthcare access and quality are influencing the healthcare staffing market in South America. Various countries are implementing policies to enhance healthcare delivery, which often includes increasing the number of healthcare professionals. For instance, Brazil's Ministry of Health has launched programs to recruit and train healthcare workers in underserved areas, which could lead to a projected increase of 15% in healthcare staffing needs over the next five years. These initiatives not only aim to address workforce shortages but also to improve the overall quality of care. As governments continue to prioritize healthcare, the staffing market is likely to see sustained growth, driven by the need for qualified personnel to fulfill these policy objectives.

Aging Population and Chronic Diseases

The demographic shift towards an aging population in South America is a significant driver for the healthcare staffing market. As the population ages, there is an increasing prevalence of chronic diseases, which requires more healthcare services. For example, it is projected that by 2030, the number of individuals aged 65 and older in South America will rise by over 30%. This demographic trend necessitates a larger workforce to provide adequate care, particularly in geriatric and chronic disease management. Consequently, healthcare facilities are likely to seek more staff, including specialized nurses and caregivers, to cater to this growing patient base. The healthcare staffing market is thus expected to adapt to these demographic changes, ensuring that the workforce is equipped to handle the complexities of aging-related health issues.

Technological Advancements in Healthcare

Technological advancements are reshaping the healthcare staffing market in South America. The integration of telemedicine, electronic health records, and artificial intelligence in healthcare settings is creating new roles and altering existing ones. For instance, the adoption of telehealth services has increased the demand for remote healthcare professionals, which could lead to a 20% rise in telehealth staffing needs by 2027. Additionally, as healthcare facilities invest in technology, there is a growing need for IT specialists and data analysts within the healthcare sector. This shift not only enhances operational efficiency but also necessitates a workforce that is adept at utilizing these technologies. Therefore, the healthcare staffing market is likely to evolve in response to these technological trends, requiring a workforce that is both skilled and adaptable.

Increased Focus on Mental Health Services

The growing awareness and recognition of mental health issues in South America are driving the healthcare staffing market. As societies become more attuned to the importance of mental health, there is a rising demand for mental health professionals, including psychologists, psychiatrists, and counselors. Recent studies indicate that mental health disorders affect approximately 20% of the population in the region, highlighting the urgent need for specialized care. Consequently, healthcare facilities are expanding their mental health services, which could lead to a 25% increase in staffing requirements in this sector over the next few years. This trend underscores the necessity for a well-trained workforce capable of addressing mental health challenges, thereby propelling the healthcare staffing market forward.