Increasing Surgical Procedures

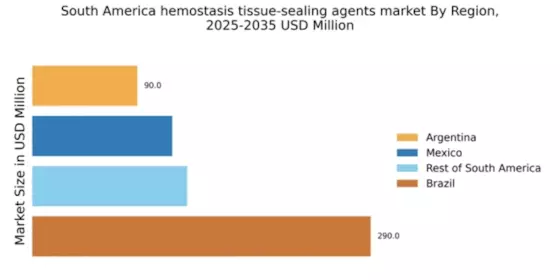

The rising number of surgical procedures in South America is a primary driver for the hemostasis tissue-sealing-agents market. As healthcare systems evolve, there is a notable increase in elective and emergency surgeries, which necessitate effective hemostatic solutions. For instance, the surgical volume in countries like Brazil and Argentina has seen a growth rate of approximately 5% annually. This trend is likely to continue, driven by advancements in surgical techniques and an aging population requiring more surgical interventions. Consequently, the demand for hemostasis tissue-sealing agents is expected to rise, as these products play a crucial role in minimizing blood loss and enhancing patient outcomes during surgeries.

Rising Incidence of Trauma Cases

The rising incidence of trauma cases in South America is a significant driver for the hemostasis tissue-sealing-agents market. With increasing road traffic accidents and violence-related injuries, there is a heightened need for effective hemostatic solutions in emergency care settings. The demand for rapid and efficient bleeding control in trauma situations is critical, leading to an increased utilization of hemostatic agents. Reports suggest that the trauma care segment could experience a growth rate of approximately 8% in the next few years, as healthcare providers seek to enhance their capabilities in managing traumatic injuries. This trend underscores the importance of hemostasis tissue-sealing agents in improving patient survival rates in critical situations.

Growing Awareness of Patient Safety

There is a growing awareness of patient safety and the importance of effective wound management in South America, which is driving the hemostasis tissue-sealing-agents market. Healthcare providers are increasingly prioritizing products that enhance patient safety during surgical procedures. This shift is reflected in the rising demand for hemostatic agents that not only control bleeding but also reduce the risk of complications. As hospitals and surgical centers implement stricter safety protocols, the market for hemostasis tissue-sealing agents is expected to expand. Reports indicate that the focus on patient safety could lead to a market growth of approximately 6% in the coming years, as healthcare facilities seek to adopt best practices in surgical care.

Regulatory Support for Innovative Solutions

Regulatory support for innovative medical solutions is another key driver for the hemostasis tissue-sealing-agents market in South America. Regulatory bodies are increasingly recognizing the need for advanced hemostatic agents that can improve surgical outcomes. This support is likely to facilitate faster approvals for new products, encouraging manufacturers to invest in research and development. As a result, the market is expected to witness an influx of innovative hemostatic solutions that meet the evolving needs of healthcare providers. The potential for expedited regulatory pathways could lead to a market expansion of around 5% over the next few years, as new products become available to address specific surgical challenges.

Technological Advancements in Medical Devices

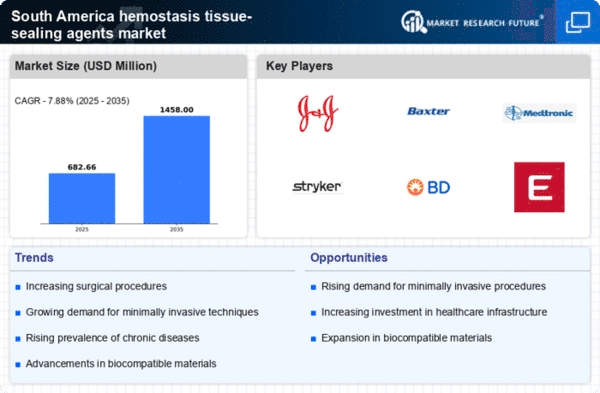

Technological innovations in medical devices are significantly influencing the hemostasis tissue-sealing-agents market. The introduction of advanced sealing agents that offer improved efficacy and safety profiles is becoming increasingly prevalent. For example, the development of bioactive hemostatic agents that promote rapid clot formation is gaining traction. In South America, the market for these advanced solutions is projected to grow at a CAGR of around 7% over the next five years. This growth is attributed to the increasing adoption of minimally invasive surgical techniques, which require effective hemostatic solutions to ensure patient safety and optimal surgical outcomes.