Rise of E-commerce Platforms

The rise of e-commerce platforms is transforming the herbal medicine market in South America. With the increasing penetration of the internet and mobile devices, consumers are now able to access a wide range of herbal products online. This shift not only enhances convenience but also allows for greater product variety and competitive pricing. E-commerce sales of herbal products are expected to account for over 30% of total sales by 2027, indicating a substantial change in consumer purchasing behavior. Additionally, online platforms often provide detailed information about product origins and benefits, which can enhance consumer confidence. This trend suggests that the herbal medicine market is likely to expand as more consumers turn to online shopping for their health needs, thereby reshaping the landscape of the industry.

Cultural Acceptance of Herbal Remedies

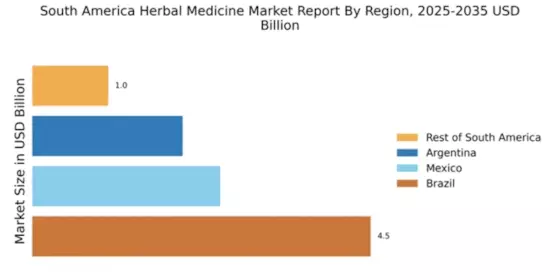

The cultural acceptance of herbal remedies plays a pivotal role in the herbal medicine market in South America. Many communities have long-standing traditions of using plants for medicinal purposes, which fosters a strong consumer base. This acceptance is reflected in the increasing demand for herbal products, with the market projected to reach approximately $1.5 billion by 2026. The integration of traditional knowledge with modern practices enhances the credibility of herbal medicine, making it a preferred choice for many consumers. Furthermore, the rise of local herbalists and practitioners contributes to the growth of this industry, as they often promote the benefits of herbal treatments. As consumers become more aware of the potential side effects of synthetic drugs, the inclination towards natural alternatives is likely to strengthen, thereby driving the herbal medicine market forward.

Regulatory Support for Herbal Products

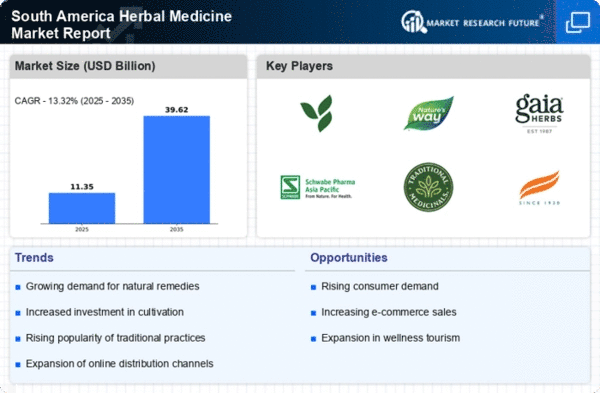

Regulatory support for herbal products is emerging as a significant driver in the herbal medicine market in South America. Governments are increasingly recognizing the importance of herbal medicine and are implementing regulations that promote the safe use of these products. For instance, the establishment of guidelines for the quality and efficacy of herbal medicines can enhance consumer trust. This regulatory framework not only protects consumers but also encourages manufacturers to invest in research and development. As a result, the market is expected to grow at a CAGR of around 8% over the next five years. The support from regulatory bodies may also facilitate the export of herbal products, opening new avenues for growth in the industry. This trend indicates a promising future for the herbal medicine market, as it aligns with the global shift towards natural health solutions.

Growing Interest in Preventive Healthcare

The growing interest in preventive healthcare is significantly influencing the herbal medicine market in South America. Consumers are increasingly seeking natural remedies to maintain health and prevent illness, rather than relying solely on conventional medicine. This shift is evident in the rising sales of herbal supplements and teas, which are perceived as safer alternatives. The market for herbal supplements is projected to grow by approximately 10% annually, reflecting a broader trend towards holistic health approaches. This inclination towards preventive measures is likely to drive innovation within the herbal medicine industry, as companies strive to develop new products that cater to health-conscious consumers. The emphasis on preventive healthcare aligns with the increasing awareness of lifestyle-related diseases, further propelling the demand for herbal solutions.

Increased Investment in Research and Development

Increased investment in research and development is a crucial driver for the herbal medicine market in South America. As the demand for herbal products rises, companies are allocating more resources to explore the therapeutic potential of various plants. This focus on R&D is essential for validating the efficacy and safety of herbal remedies, which can lead to greater acceptance among healthcare professionals and consumers alike. The market is witnessing a surge in clinical trials and studies aimed at understanding the benefits of herbal ingredients, with funding from both private and public sectors. This investment is expected to yield innovative products and formulations, potentially increasing the market size by 15% over the next few years. The emphasis on scientific validation may also enhance the reputation of the herbal medicine industry, positioning it as a credible alternative to conventional treatments.