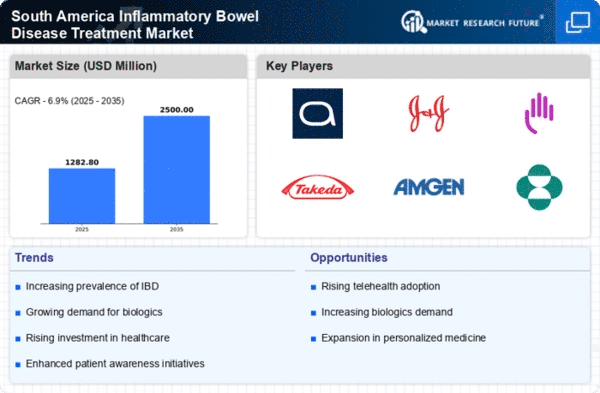

Growing Incidence of IBD

The growing incidence of inflammatory bowel disease in South America is a primary driver of the treatment market. Recent studies indicate that the prevalence of IBD has increased by 10% over the past five years, with urban areas experiencing higher rates due to lifestyle changes. This rise in incidence necessitates a corresponding increase in treatment options and healthcare resources. In 2023, it was estimated that over 1 million individuals in South America were living with IBD, highlighting the urgent need for effective therapies. As the patient population expands, the inflammatory bowel-disease-treatment market is likely to grow, driven by the demand for innovative and effective treatment solutions.

Rising Awareness and Education

There is a notable increase in awareness and education regarding inflammatory bowel disease in South America, which significantly impacts the treatment market. Campaigns aimed at educating both healthcare professionals and the public about IBD symptoms and management are becoming more prevalent. This heightened awareness leads to earlier diagnosis and treatment, which is essential for effective disease management. In 2023, surveys indicated that 60% of the population in major South American cities recognized the symptoms of IBD, a substantial increase from previous years. As awareness grows, more patients seek medical help, thereby driving demand for treatments in the inflammatory bowel-disease-treatment market. This trend indicates a positive trajectory for market growth as informed patients are more likely to pursue available therapies.

Increasing Healthcare Expenditure

The rising healthcare expenditure in South America is a crucial driver for the inflammatory bowel-disease-treatment market. Governments and private sectors are investing more in healthcare infrastructure, which enhances access to advanced treatment options for inflammatory bowel disease (IBD). In 2023, healthcare spending in the region reached approximately $200 billion, reflecting a growth of 5% from the previous year. This increase allows for better diagnostic tools and therapies, thereby improving patient outcomes. Furthermore, as more funds are allocated to healthcare, the availability of innovative treatments, such as biologics and biosimilars, is likely to expand. This trend suggests that the inflammatory bowel-disease-treatment market will continue to grow, driven by improved healthcare access and the introduction of new therapies.

Supportive Regulatory Environment

A supportive regulatory environment in South America is fostering growth in the inflammatory bowel-disease-treatment market. Regulatory agencies are increasingly streamlining the approval processes for new therapies, which encourages pharmaceutical companies to invest in research and development. In 2023, the average time for drug approval decreased by 20%, allowing for quicker access to innovative treatments. This regulatory support is crucial for the introduction of new medications, particularly biologics and biosimilars, which are essential for managing IBD. As the regulatory landscape continues to evolve favorably, it is likely that the inflammatory bowel-disease-treatment market will experience accelerated growth, benefiting both patients and healthcare providers.

Technological Advancements in Treatment

Technological advancements in treatment modalities are significantly influencing the inflammatory bowel-disease-treatment market in South America. Innovations such as telemedicine, mobile health applications, and advanced biologic therapies are transforming how patients manage their conditions. In 2023, the adoption of telehealth services increased by 30%, allowing patients to consult specialists without geographical constraints. This shift not only improves access to care but also enhances patient adherence to treatment regimens. Moreover, the introduction of new biologics has expanded treatment options, with the market for these therapies projected to grow by 15% annually. Such advancements suggest a robust future for the inflammatory bowel-disease-treatment market, as they facilitate better management of IBD and improve patient outcomes.