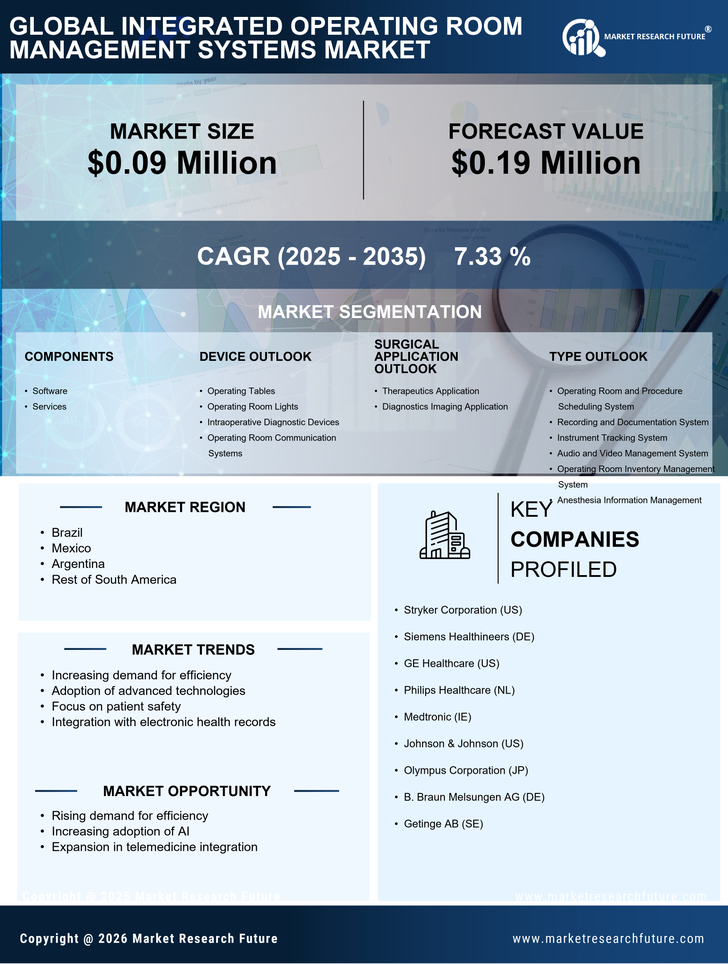

Rising Demand for Surgical Efficiency

The integrated operating-room-management-systems market in South America is experiencing a notable surge in demand for enhanced surgical efficiency. Hospitals and surgical centers are increasingly adopting these systems to streamline operations, reduce delays, and optimize resource allocation. This trend is driven by the need to improve patient throughput and minimize surgical wait times. According to recent data, the adoption of integrated systems has led to a reduction in surgical delays by approximately 30%, thereby enhancing overall operational efficiency. As healthcare providers strive to meet the growing expectations of patients and regulatory bodies, the emphasis on surgical efficiency is likely to propel the integrated operating-room-management-systems market forward.

Focus on Cost Reduction in Healthcare Delivery

Cost reduction remains a pivotal driver for the integrated operating-room-management-systems market in South America. Healthcare providers are under constant pressure to manage expenses while maintaining high-quality care. Integrated systems offer solutions that streamline processes, reduce waste, and enhance resource management, leading to significant cost savings. Reports indicate that hospitals utilizing these systems have achieved a reduction in operational costs by up to 20%. This focus on cost efficiency is likely to encourage more healthcare facilities to invest in integrated operating-room-management-systems, thereby expanding the market.

Growing Emphasis on Data-Driven Decision Making

The integrated operating-room-management-systems market in South America is witnessing a growing emphasis on data-driven decision making. Healthcare providers are increasingly recognizing the value of data analytics in optimizing surgical workflows and improving patient care. By utilizing integrated systems, hospitals can collect and analyze data related to surgical performance, patient outcomes, and resource utilization. This trend is likely to enhance operational transparency and accountability, as evidenced by a reported 25% improvement in decision-making efficiency among facilities that have adopted these systems. As data becomes a critical asset in healthcare, the demand for integrated operating-room-management-systems is expected to rise.

Increased Investment in Healthcare Infrastructure

In South America, there is a marked increase in investment in healthcare infrastructure, which is significantly impacting the integrated operating-room-management-systems market. Governments and private entities are channeling funds into modernizing hospitals and surgical facilities, thereby creating a conducive environment for the adoption of advanced management systems. This investment is expected to reach approximately $10 billion by 2026, reflecting a commitment to improving healthcare delivery. Enhanced infrastructure not only facilitates the implementation of integrated systems but also ensures that healthcare providers can leverage technology to improve patient outcomes and operational efficiency.

Advancements in Telemedicine and Remote Monitoring

The rise of telemedicine and remote monitoring technologies is influencing the integrated operating-room-management-systems market in South America. As healthcare providers increasingly adopt telehealth solutions, there is a growing need for integrated systems that can seamlessly connect surgical teams with remote specialists. This integration facilitates real-time consultations and enhances surgical planning, ultimately improving patient outcomes. The market for telemedicine in South America is projected to grow by 15% annually, indicating a strong potential for integrated operating-room-management-systems to evolve alongside these advancements. This synergy may lead to more efficient surgical procedures and better resource utilization.