Focus on Cost Reduction

Cost containment is a critical concern for healthcare providers in the UK, driving the demand for integrated operating-room-management-systems. Hospitals are under pressure to reduce operational costs while improving patient care quality. Integrated systems can help achieve this by optimizing resource utilization, minimizing waste, and enhancing workflow efficiency. For instance, studies indicate that hospitals implementing these systems can reduce operating costs by up to 20%, making them an attractive investment. As healthcare budgets tighten, the integrated operating-room-management-systems market is likely to benefit from this focus on cost reduction, as facilities seek solutions that provide both financial and operational advantages.

Rising Surgical Procedures

The increasing number of surgical procedures performed in the UK is a significant driver for the integrated operating-room-management-systems market. As the population ages and the prevalence of chronic diseases rises, the demand for surgical interventions is expected to grow. According to recent statistics, the number of elective surgeries has increased by over 15% in the past five years, necessitating more efficient management systems in operating rooms. This trend indicates that healthcare facilities are seeking integrated solutions to optimize scheduling, resource allocation, and patient flow. Consequently, the market is likely to expand as hospitals invest in systems that can handle the complexities of increased surgical volumes while maintaining high standards of care and safety.

Technological Advancements in Healthcare

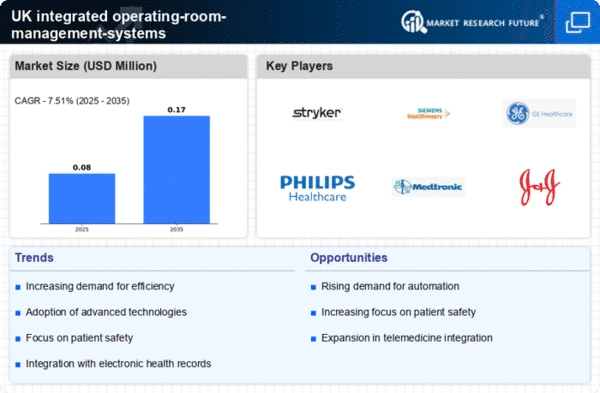

The integrated operating-room-management-systems market is experiencing a surge due to rapid technological advancements in healthcare. Innovations such as artificial intelligence (AI) and machine learning are enhancing surgical workflows, improving patient outcomes, and streamlining operations. These technologies enable real-time data analysis, which is crucial for effective decision-making in operating rooms. The integration of advanced imaging systems and robotic-assisted surgeries is also contributing to the growth of this market. As hospitals and surgical centers in the UK increasingly adopt these technologies, the demand for integrated systems that can seamlessly manage these innovations is likely to rise. This trend suggests that the market could see a compound annual growth rate (CAGR) of approximately 10% over the next few years, reflecting the growing reliance on technology in surgical environments.

Emphasis on Patient Safety and Quality of Care

Patient safety and quality of care are paramount in the healthcare sector, significantly influencing the integrated operating-room-management-systems market. The increasing awareness of patient safety issues has led to a demand for systems that can enhance surgical outcomes and reduce errors. Integrated systems facilitate better communication among surgical teams, streamline processes, and provide real-time data access, which is essential for maintaining high standards of care. Regulatory bodies in the UK are also emphasizing the need for improved safety protocols, further driving the adoption of these systems. As hospitals strive to meet these standards, the market is expected to grow, reflecting the ongoing commitment to patient safety and quality.

Integration of Telemedicine and Remote Monitoring

The integration of telemedicine and remote monitoring technologies is emerging as a key driver for the integrated operating-room-management-systems market. As healthcare providers in the UK increasingly adopt telehealth solutions, there is a growing need for systems that can seamlessly incorporate these technologies into surgical workflows. Remote monitoring allows for better preoperative assessments and postoperative follow-ups, enhancing patient care. This trend suggests that integrated systems capable of supporting telemedicine functionalities will be in high demand. The market may witness substantial growth as healthcare facilities recognize the benefits of combining traditional surgical management with modern telehealth capabilities, potentially leading to improved patient outcomes and operational efficiencies.