Rising Dental Awareness

The increasing awareness of oral health among the population in South America is driving the intraoral cameras market. As individuals become more informed about the importance of dental hygiene and regular check-ups, the demand for advanced diagnostic tools, such as intraoral cameras, is likely to rise. This trend is particularly evident in urban areas where access to dental care is improving. The intraoral cameras market is expected to benefit from this heightened awareness, as patients seek more effective and efficient ways to monitor their oral health. Furthermore, educational campaigns by dental associations are contributing to this awareness, potentially leading to a market growth rate of around 15% annually in the coming years.

Rising Geriatric Population

The increasing geriatric population in South America is a significant factor influencing the intraoral cameras market. As the elderly demographic grows, there is a corresponding rise in dental issues that require effective diagnostic tools. Intraoral cameras provide a non-invasive means to assess oral health, making them essential in geriatric dentistry. The intraoral cameras market is likely to experience heightened demand as dental practices adapt to cater to the needs of older patients. Projections suggest that the market could expand by approximately 8% annually, driven by the necessity for specialized dental care for the aging population.

Growth of Cosmetic Dentistry

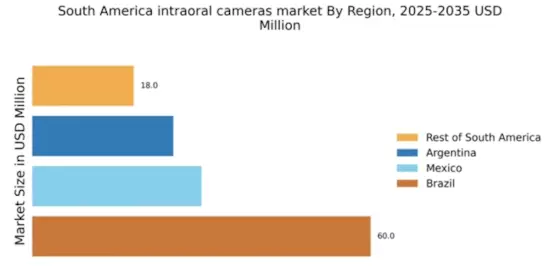

The rising popularity of cosmetic dentistry in South America is a notable driver for the intraoral cameras market. As more individuals seek aesthetic dental procedures, the need for precise imaging tools becomes paramount. Intraoral cameras facilitate detailed assessments, allowing dentists to provide tailored treatment plans. This trend is particularly pronounced in countries like Brazil and Argentina, where cosmetic procedures are increasingly sought after. The intraoral cameras market is likely to see a surge in demand, with projections indicating a growth rate of around 12% over the next five years, driven by the expanding cosmetic dentistry sector.

Technological Integration in Dentistry

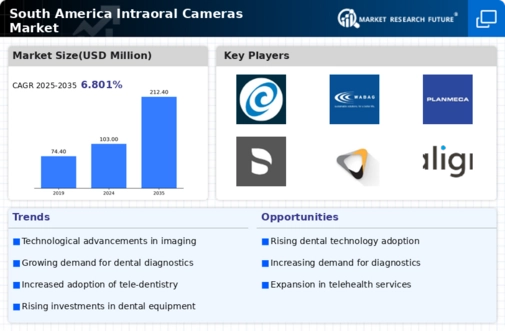

The integration of advanced technologies in dental practices is significantly influencing the intraoral cameras market. Innovations such as high-definition imaging, wireless connectivity, and real-time data sharing are enhancing the functionality of intraoral cameras. As dental practitioners in South America adopt these technologies, the demand for sophisticated imaging solutions is likely to increase. The intraoral cameras market is witnessing a shift towards digital dentistry, where intraoral cameras play a crucial role in diagnostics and treatment planning. This technological evolution could lead to a market expansion valued at approximately $50 million by 2027, reflecting the growing reliance on digital tools in dental practices.

Increasing Investment in Dental Infrastructure

The ongoing investment in dental infrastructure across South America is positively impacting the intraoral cameras market. Governments and private entities are allocating funds to enhance dental facilities, particularly in underserved regions. This investment is aimed at improving access to quality dental care, which in turn drives the demand for modern diagnostic tools like intraoral cameras. The intraoral cameras market is expected to benefit from this trend, as newly established clinics and practices seek to equip themselves with the latest technology. It is estimated that the market could grow by 10% annually as a result of these infrastructural developments.