Growing Aesthetic Dentistry Sector

The aesthetic dentistry sector is expanding rapidly, contributing significantly to the Intraoral Cameras Market. As more individuals prioritize cosmetic enhancements, the demand for procedures such as teeth whitening, veneers, and orthodontics is on the rise. Intraoral cameras Market are essential in this context, as they provide clear visualizations that aid in treatment planning and patient education. Market data suggests that the aesthetic dentistry segment is expected to witness a growth rate of around 10% annually, further propelling the adoption of intraoral cameras. This trend underscores the importance of visual aids in communicating treatment options and outcomes to patients, thereby enhancing their overall experience.

Increased Focus on Patient Education

The Intraoral Cameras Market is significantly influenced by the growing emphasis on patient education. Dentists are increasingly utilizing intraoral cameras to visually demonstrate dental conditions to patients, fostering a better understanding of their oral health. This approach not only enhances patient engagement but also encourages informed decision-making regarding treatment options. Research indicates that patients who are actively involved in their treatment process are more likely to adhere to recommended care plans. As a result, the demand for intraoral cameras is likely to rise, as they serve as effective tools for enhancing communication and education within dental practices.

Technological Innovations in Imaging

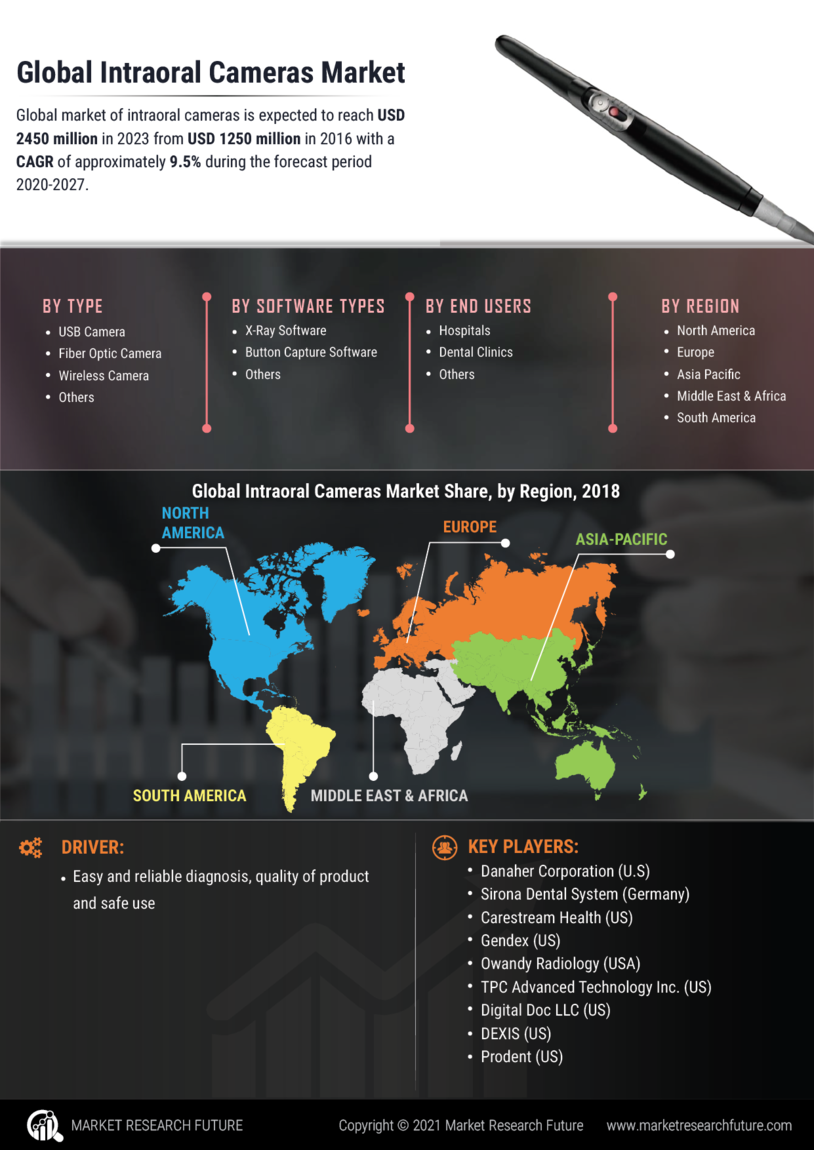

Technological advancements play a pivotal role in shaping the Intraoral Cameras Market. Innovations such as high-definition imaging, enhanced lighting, and wireless connectivity are transforming the capabilities of intraoral cameras. These advancements enable dentists to capture detailed images of oral structures, facilitating better diagnosis and treatment planning. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years, driven by these technological improvements. Furthermore, the integration of artificial intelligence in imaging analysis is expected to enhance diagnostic precision, making intraoral cameras indispensable tools in modern dental practices.

Rising Demand for Preventive Dentistry

The Intraoral Cameras Market is experiencing a notable increase in demand for preventive dentistry. As awareness regarding oral health continues to grow, patients are seeking more proactive approaches to dental care. Intraoral cameras Market facilitate early detection of dental issues, allowing for timely intervention. This trend is supported by data indicating that preventive dental care can reduce overall treatment costs by up to 40%. Consequently, dental practitioners are increasingly adopting intraoral cameras to enhance diagnostic accuracy and improve patient outcomes. The integration of these devices into routine examinations not only fosters patient trust but also encourages regular visits, thereby driving the growth of the Intraoral Cameras Market.

Expansion of Dental Practices and Clinics

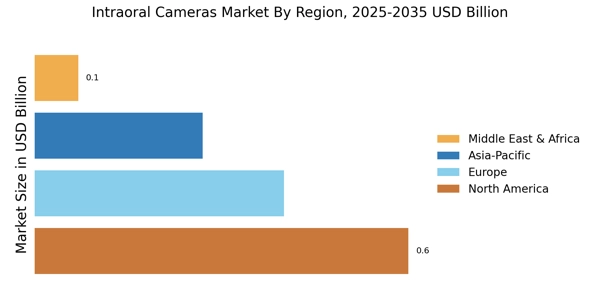

The expansion of dental practices and clinics is a driving force behind the growth of the Intraoral Cameras Market. As the number of dental facilities increases, so does the need for advanced diagnostic tools. Intraoral cameras Market are becoming standard equipment in new dental practices, as they enhance the quality of care provided. Market analysis reveals that the number of dental clinics is projected to grow by approximately 5% annually, leading to a higher adoption rate of intraoral cameras. This trend reflects a broader movement towards modernizing dental practices, ensuring that they are equipped with the latest technology to meet patient expectations and improve treatment outcomes.