Increasing Prevalence of IBS

The rising incidence of irritable bowel syndrome (IBS) in South America is a crucial driver for the irritable bowel-syndrome-treatment market. Recent studies indicate that approximately 10-15% of the population in this region experiences IBS symptoms, leading to a growing demand for effective treatment options. This increasing prevalence is attributed to various factors, including dietary changes, stress, and lifestyle modifications. As more individuals seek medical attention for their symptoms, healthcare providers are compelled to enhance their treatment offerings. Consequently, pharmaceutical companies are investing in research and development to create innovative therapies tailored to the unique needs of the South American population. This trend is likely to bolster the irritable bowel-syndrome-treatment market, as more patients are diagnosed and treated, thereby expanding the overall market size.

Rising Healthcare Expenditure

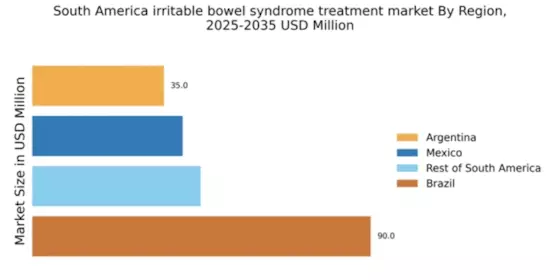

The upward trend in healthcare spending across South America is a significant driver for the irritable bowel-syndrome-treatment market. Governments and private sectors are increasingly allocating funds to improve healthcare infrastructure and access to treatments. As a result, patients are more likely to seek medical advice and treatment for IBS, which has historically been underdiagnosed. The increase in healthcare expenditure is expected to enhance the availability of diagnostic tools and treatment options, making it easier for patients to receive appropriate care. This trend is particularly evident in countries like Brazil and Argentina, where healthcare reforms are underway. The growing investment in healthcare is likely to stimulate the irritable bowel-syndrome-treatment market, as more individuals gain access to necessary treatments and therapies.

Advancements in Treatment Options

Innovations in treatment modalities are significantly influencing the irritable bowel-syndrome-treatment market. The introduction of novel pharmacological agents, such as gut-targeted therapies and probiotics, has expanded the therapeutic landscape for IBS. These advancements not only improve symptom management but also enhance patient quality of life. In South America, the market for IBS treatments is projected to grow at a CAGR of around 6% over the next few years, driven by the increasing availability of these advanced treatment options. Furthermore, the development of combination therapies that address multiple symptoms simultaneously is gaining traction. This diversification in treatment options is likely to attract more patients seeking relief from their IBS symptoms, thereby propelling the growth of the irritable bowel-syndrome-treatment market.

Regulatory Support for New Treatments

Regulatory bodies in South America are increasingly supportive of the introduction of new treatments for IBS, which serves as a significant driver for the irritable bowel-syndrome-treatment market. Streamlined approval processes for innovative therapies are encouraging pharmaceutical companies to invest in research and development. This regulatory environment fosters a more dynamic market, allowing for the rapid introduction of effective treatments. As new therapies receive approval, patients gain access to a broader range of options, which may lead to improved management of their symptoms. The proactive stance of regulatory agencies is likely to stimulate growth in the irritable bowel-syndrome-treatment market, as it encourages innovation and enhances treatment accessibility for patients.

Enhanced Patient Education and Support

The emphasis on patient education and support programs is emerging as a vital driver for the irritable bowel-syndrome-treatment market. In South America, healthcare providers are increasingly recognizing the importance of educating patients about IBS, its symptoms, and available treatment options. This focus on education aims to empower patients to take an active role in managing their condition. Support groups and online resources are becoming more prevalent, providing patients with valuable information and community support. As awareness grows, more individuals are likely to seek treatment for their IBS symptoms, thereby expanding the market. This trend indicates a shift towards a more patient-centered approach in healthcare, which is expected to positively impact the irritable bowel-syndrome-treatment market.