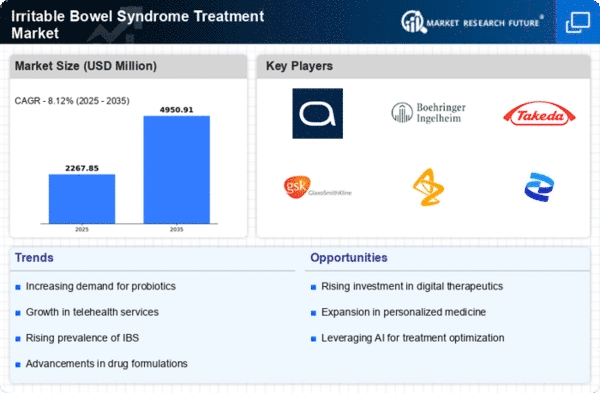

The Irritable Bowel Syndrome Treatment Market is characterized by a dynamic competitive landscape, driven by increasing prevalence rates and a growing demand for effective therapies. Key players such as AbbVie (US), Takeda Pharmaceutical Company (JP), and Ironwood Pharmaceuticals (US) are strategically positioned to leverage innovation and partnerships to enhance their market presence. AbbVie (US) focuses on developing novel therapies, while Takeda Pharmaceutical Company (JP) emphasizes regional expansion and collaboration with healthcare providers. Ironwood Pharmaceuticals (US) is dedicated to digital transformation, utilizing technology to improve patient engagement and treatment adherence. Collectively, these strategies contribute to a competitive environment that prioritizes innovation and patient-centric solutions.

In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market appears moderately fragmented, with several key players exerting influence over specific segments. This structure allows for a diverse range of treatment options, catering to varying patient needs and preferences, while also fostering competition among established and emerging companies.

In November 2025, AbbVie (US) announced a strategic partnership with a leading digital health company to develop a comprehensive platform aimed at improving patient outcomes in IBS treatment. This collaboration is expected to integrate advanced analytics and telehealth solutions, thereby enhancing patient monitoring and adherence to treatment regimens. Such initiatives reflect AbbVie's commitment to leveraging technology to address the complexities of IBS management.

In October 2025, Takeda Pharmaceutical Company (JP) launched a new clinical trial for a novel IBS treatment, focusing on a unique mechanism of action that targets gut microbiota. This strategic move not only underscores Takeda's dedication to innovation but also positions the company to potentially capture a significant share of the market by addressing unmet medical needs. The trial's outcomes could pave the way for a breakthrough therapy, further solidifying Takeda's reputation as a leader in gastrointestinal treatments.

In September 2025, Ironwood Pharmaceuticals (US) expanded its product portfolio by acquiring a promising IBS treatment candidate from a biotech firm. This acquisition is likely to enhance Ironwood's competitive edge by diversifying its offerings and accelerating its entry into new market segments. The strategic importance of this move lies in Ironwood's ability to leverage its existing infrastructure to bring the new treatment to market swiftly, thereby meeting the growing demand for effective IBS therapies.

As of December 2025, current competitive trends in the Irritable Bowel Syndrome Treatment Market indicate a strong emphasis on digitalization, sustainability, and the integration of artificial intelligence (AI) in treatment protocols. Strategic alliances among key players are shaping the landscape, fostering innovation and enhancing patient care. Looking ahead, competitive differentiation is expected to evolve, with a shift from price-based competition to a focus on technological advancements, innovative treatment solutions, and reliable supply chains. This transition may redefine how companies position themselves in the market, ultimately benefiting patients through improved treatment options.