Evolving Legal Frameworks

The evolving legal frameworks across South America are pivotal in shaping the legal marijuana market. Countries like Uruguay and Colombia have established regulatory structures that facilitate the cultivation and distribution of cannabis. This regulatory clarity encourages investment and innovation within the sector. For instance, Colombia's legal marijuana market is projected to reach $1.5 billion by 2028, driven by both domestic and international demand. As more nations consider legalization, the legal marijuana market is likely to expand, attracting new players and fostering competition. The establishment of clear guidelines not only enhances consumer safety but also promotes responsible use, which is essential for the industry's long-term sustainability.

Cultural Shifts and Acceptance

Cultural shifts towards acceptance of marijuana use are reshaping the legal marijuana market in South America. As societal attitudes evolve, there is a growing recognition of cannabis as a legitimate product rather than a taboo substance. This change is reflected in the increasing number of cannabis-related events and educational initiatives aimed at informing the public about its benefits. Surveys indicate that approximately 60% of South Americans support legalization, which is likely to drive demand for legal marijuana products. The cultural acceptance of cannabis not only enhances market visibility but also encourages responsible consumption, thereby fostering a healthier industry environment.

Increased Medical Applications

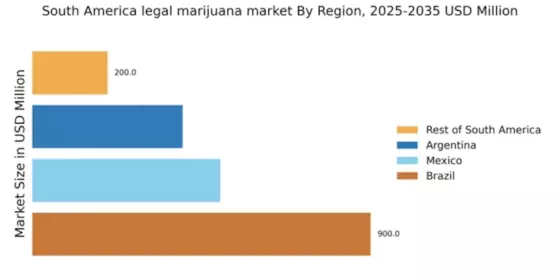

The increasing recognition of marijuana's medicinal properties is significantly influencing the legal marijuana market in South America. Medical cannabis is being utilized for various conditions, including chronic pain, epilepsy, and anxiety disorders. Countries like Argentina and Brazil are witnessing a surge in demand for medical marijuana products, with the market expected to grow at a CAGR of 20% over the next five years. This growth is fueled by a rising number of healthcare professionals advocating for cannabis-based treatments. As more patients seek alternative therapies, the legal marijuana market is likely to see an influx of innovative products and services tailored to meet medical needs.

Economic Growth and Job Creation

The potential for economic growth and job creation within the legal marijuana market is becoming increasingly evident in South America. As countries legalize cannabis, new business opportunities arise, leading to job creation in agriculture, retail, and ancillary services. For example, the legal marijuana market in Colombia is expected to generate over 10,000 jobs by 2025, contributing to local economies. This economic impact is particularly significant in rural areas where cannabis cultivation can provide a sustainable income source for farmers. The infusion of capital into the legal marijuana market not only stimulates economic activity but also enhances community development.

International Trade Opportunities

The emergence of international trade opportunities is a crucial driver for the legal marijuana market in South America. As countries like Uruguay and Colombia establish themselves as leaders in cannabis production, they are positioned to export products to markets with high demand, such as North America and Europe. The potential for lucrative trade agreements could significantly boost the legal marijuana market, with estimates suggesting that exports could reach $500 million by 2030. This international focus not only enhances the visibility of South American cannabis products but also encourages compliance with global standards, thereby improving product quality and safety.