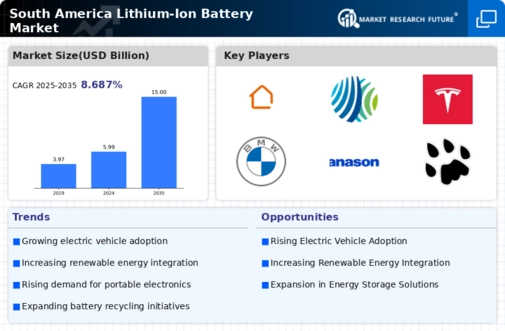

Growth of Energy Storage Systems

The lithium ion-battery market in South America is significantly influenced by the growth of energy storage systems (ESS). As the region seeks to enhance grid stability and integrate renewable energy sources, ESS are becoming increasingly vital. The market for energy storage is expected to expand by 20% annually, driven by both residential and commercial applications. This growth is indicative of a broader trend towards decentralized energy solutions, where lithium ion batteries play a crucial role in storing excess energy generated from renewable sources. The increasing focus on energy resilience and efficiency is likely to propel the lithium ion-battery market forward.

Expansion of Consumer Electronics

The proliferation of consumer electronics in South America is driving demand for the lithium ion-battery market. With the increasing adoption of smartphones, laptops, and wearable devices, the need for efficient and long-lasting batteries is paramount. In 2025, the consumer electronics sector in South America is projected to grow by 15%, further amplifying the demand for lithium ion batteries. This growth is fueled by a tech-savvy population and rising disposable incomes, which enable consumers to invest in advanced electronic devices. Consequently, manufacturers are focusing on enhancing battery performance and reducing costs, which could lead to innovations in the lithium ion-battery market.

Surge in Renewable Energy Projects

The lithium ion-battery market in South America is experiencing a notable surge due to the increasing investment in renewable energy projects. Countries like Brazil and Chile are prioritizing solar and wind energy, which necessitates efficient energy storage solutions. Lithium ion batteries are pivotal in this context, as they provide the necessary storage capacity to manage the intermittent nature of renewable sources. In 2025, it is estimated that the region's renewable energy capacity will reach approximately 200 GW, with a significant portion relying on lithium ion technology for energy storage. This trend indicates a robust growth trajectory for the lithium ion-battery market, as energy storage becomes integral to achieving energy independence and sustainability goals.

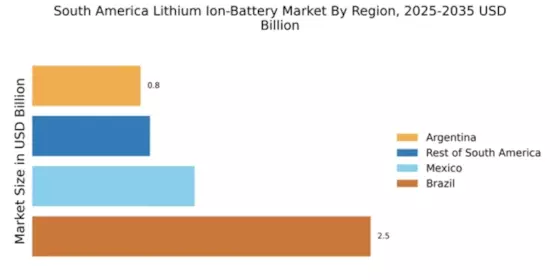

Emergence of Local Battery Manufacturing

The emergence of local battery manufacturing facilities in South America is poised to transform the lithium ion-battery market. Countries such as Argentina and Brazil are investing in domestic production capabilities to reduce reliance on imports and enhance supply chain resilience. This shift is expected to lower production costs and improve the availability of lithium ion batteries in the region. By 2025, local manufacturing could account for up to 40% of the market share, fostering innovation and competition. This development not only supports the growth of the lithium ion-battery market but also contributes to job creation and economic development within the region.

Government Incentives for Electric Mobility

Government incentives aimed at promoting electric mobility are a key driver for the lithium ion-battery market in South America. Various countries are implementing policies to encourage the adoption of electric vehicles (EVs), including tax breaks and subsidies. For instance, Brazil has introduced incentives that could reduce the cost of EVs by up to 30%, thereby stimulating market growth. As the EV market expands, the demand for lithium ion batteries is expected to rise correspondingly. This trend suggests a promising outlook for the lithium ion-battery market, as it aligns with global efforts to reduce carbon emissions and promote sustainable transportation.