Expansion of Cosmetic Clinics

The proliferation of cosmetic clinics across South America is significantly impacting the medical aesthetics market. As more clinics open, access to aesthetic treatments becomes easier for consumers. This expansion is fueled by the increasing popularity of aesthetic procedures, which has led to a competitive landscape among service providers. In 2025, the number of cosmetic clinics in major cities is expected to rise by 15%, providing a wider array of services to meet consumer demands. This growth not only enhances accessibility but also encourages innovation in treatment offerings, thereby stimulating the overall market. The medical aesthetics market is likely to benefit from this trend as clinics strive to attract a diverse clientele.

Rising Influence of Beauty Standards

Cultural shifts in beauty standards are playing a crucial role in shaping the medical aesthetics market in South America. The increasing emphasis on youthful appearance and physical attractiveness is driving more individuals to seek aesthetic treatments. Surveys indicate that approximately 60% of consumers in urban areas express a desire to undergo cosmetic procedures to align with contemporary beauty ideals. This societal pressure is likely to fuel the growth of the medical aesthetics market, as individuals invest in treatments that enhance their appearance. Furthermore, the normalization of aesthetic procedures in popular culture may lead to a broader acceptance of such treatments, further expanding the consumer base.

Technological Innovations in Treatments

Technological advancements are revolutionizing the medical aesthetics market in South America. Innovations in treatment techniques and equipment are enhancing the efficacy and safety of procedures. For instance, the introduction of laser technologies and minimally invasive techniques has made treatments more appealing to consumers. The market is witnessing a shift towards devices that offer quicker recovery times and improved results. As a result, the adoption of these technologies is expected to increase, with a projected growth rate of 12% in the next few years. This trend not only attracts new clients but also retains existing ones, thereby bolstering the medical aesthetics market.

Growing Acceptance of Aesthetic Procedures

The medical aesthetics market in South America is benefiting from a growing acceptance of aesthetic procedures among various demographics. Historically, such treatments were often stigmatized, but this perception is changing. Increasingly, individuals from diverse age groups and backgrounds are embracing aesthetic enhancements as a form of self-expression. Recent studies suggest that nearly 50% of adults in urban areas are open to considering aesthetic treatments. This shift in mindset is likely to expand the consumer base and drive market growth. As acceptance continues to rise, the medical aesthetics market may see a diversification of services tailored to meet the needs of a broader audience.

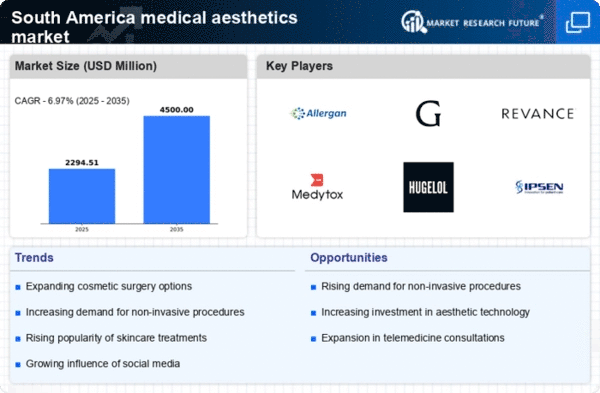

Increasing Demand for Aesthetic Treatments

The medical aesthetics market in South America is experiencing a notable surge in demand for aesthetic treatments. This trend is driven by a growing awareness of personal appearance and the desire for non-invasive procedures. According to recent data, the market is projected to grow at a CAGR of approximately 10% over the next five years. Factors such as rising disposable incomes and an expanding middle class contribute to this increasing demand. Consumers are increasingly seeking treatments that enhance their physical appearance without the need for extensive recovery times. This shift in consumer behavior is likely to propel the medical aesthetics market forward, as more individuals prioritize self-care and aesthetic enhancement.