Increasing Healthcare Expenditure

The rising healthcare expenditure in South America is a pivotal driver for the medical device-cleaning market. Governments and private sectors are investing more in healthcare infrastructure, which includes the procurement of advanced medical devices. As healthcare facilities expand, the demand for effective cleaning solutions to maintain these devices increases. In 2023, healthcare spending in South America was estimated to reach approximately $500 billion, with a projected growth rate of 5% annually. This trend indicates a growing recognition of the importance of maintaining hygiene standards, thereby propelling the medical device-cleaning market forward. The emphasis on cleanliness and infection control in healthcare settings further underscores the necessity for efficient cleaning solutions, which are essential for patient safety and operational efficiency.

Technological Innovations in Cleaning Equipment

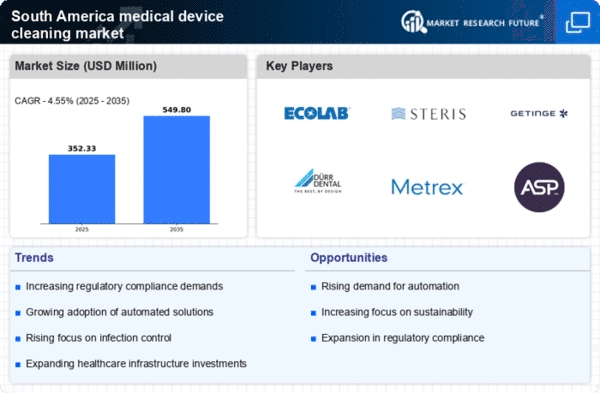

Technological innovations in cleaning equipment are transforming the medical device-cleaning market in South America. The introduction of automated cleaning systems and advanced disinfection technologies enhances the efficiency and effectiveness of cleaning processes. For instance, the adoption of robotic cleaning devices has gained traction, as they can operate continuously and reduce human error. The market for such technologies is projected to grow at a CAGR of 7% over the next five years. These innovations not only improve cleaning outcomes but also reduce labor costs and time, making them attractive to healthcare facilities. As the demand for high-quality cleaning solutions rises, the medical device-cleaning market is poised to benefit from these advancements, ensuring compliance with hygiene standards and improving overall patient care.

Growing Awareness of Infection Control Practices

The growing awareness of infection control practices among healthcare professionals and patients is a crucial driver for the medical device-cleaning market. Educational initiatives and training programs are increasingly emphasizing the importance of proper cleaning and disinfection protocols. This heightened awareness leads to a greater demand for effective cleaning solutions that can meet stringent hygiene standards. In South America, healthcare facilities are adopting comprehensive infection control strategies, which include regular training for staff on cleaning practices. As a result, the medical device-cleaning market is likely to expand, as healthcare providers seek reliable products that can ensure the safety of patients and staff alike. This trend reflects a broader commitment to improving healthcare quality and reducing the risk of infections.

Regulatory Pressure for Enhanced Cleaning Standards

Regulatory pressure for enhanced cleaning standards is a significant driver of the medical device-cleaning market in South America. Regulatory bodies are increasingly enforcing stringent guidelines to ensure the safety and efficacy of medical devices. Compliance with these regulations necessitates the use of effective cleaning solutions and practices. In recent years, several countries in South America have updated their healthcare regulations to include specific requirements for cleaning and disinfection processes. This shift compels healthcare facilities to invest in advanced cleaning technologies and products that meet these standards. As a result, the medical device-cleaning market is expected to grow as manufacturers and healthcare providers adapt to the evolving regulatory landscape, ensuring that they maintain compliance while safeguarding patient health.

Rising Incidence of Healthcare-Associated Infections

The increasing incidence of healthcare-associated infections (HAIs) in South America significantly impacts the medical device-cleaning market. HAIs pose a serious threat to patient safety and healthcare quality, leading to heightened awareness among healthcare providers regarding the importance of stringent cleaning protocols. According to recent studies, HAIs affect approximately 8% of hospitalized patients in the region, prompting healthcare facilities to invest in advanced cleaning technologies and solutions. This growing concern drives the demand for effective cleaning agents and equipment that can ensure the thorough disinfection of medical devices. Consequently, the medical device-cleaning market is likely to experience substantial growth as healthcare facilities prioritize infection control measures to safeguard patient health and comply with regulatory standards.