Increased Focus on Patient Safety

In South America, there is a growing emphasis on patient safety, which is driving the medical terminology-software market. Healthcare organizations are increasingly recognizing the importance of accurate medical terminology in reducing errors and improving patient outcomes. The implementation of software that standardizes medical language can significantly mitigate risks associated with miscommunication. As a result, healthcare providers are investing in solutions that enhance the clarity and consistency of medical documentation. This trend is likely to contribute to a projected growth of 15% in the medical terminology-software market by 2027, as organizations prioritize patient safety and quality of care.

Expansion of Telemedicine Services

The medical terminology-software market is significantly influenced by the expansion of telemedicine services across South America. As healthcare providers increasingly offer remote consultations and digital health services, the demand for precise medical terminology software rises. This software is essential for ensuring that healthcare professionals can communicate effectively and accurately document patient information during virtual visits. The telemedicine market in South America is expected to reach $2 billion by 2026, indicating a robust growth trajectory. This expansion not only enhances access to healthcare but also necessitates the use of sophisticated medical terminology software to maintain high standards of care and documentation.

Growing Need for Interoperable Systems

The medical terminology-software market in South America is increasingly driven by the growing need for interoperable systems within healthcare. As healthcare providers strive to share information seamlessly across different platforms, the demand for software that can standardize medical terminology becomes critical. Interoperability is essential for ensuring that patient data is accurately exchanged and understood among various healthcare stakeholders. The market for interoperable health IT solutions is projected to grow by 10% annually, reflecting the urgency for systems that can communicate effectively. This trend underscores the importance of medical terminology software in facilitating interoperability and enhancing overall healthcare delivery.

Rising Demand for Healthcare Digitization

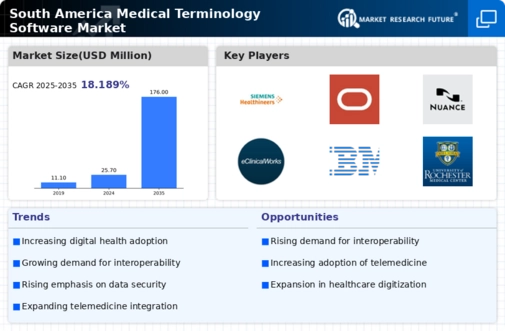

The medical terminology-software market in South America is experiencing a notable surge in demand due to the ongoing digitization of healthcare services. As healthcare providers increasingly adopt electronic health records (EHR) and other digital solutions, the need for accurate medical terminology software becomes paramount. This trend is driven by the necessity to enhance patient care, streamline operations, and improve data management. According to recent estimates, the healthcare IT market in South America is projected to grow at a CAGR of approximately 12% from 2025 to 2030. This growth is likely to propel the medical terminology-software market, as organizations seek to integrate advanced software solutions that facilitate better communication and understanding of medical data.

Government Initiatives for Health IT Development

Government initiatives aimed at promoting health IT development are playing a crucial role in shaping the medical terminology-software market in South America. Various countries in the region are implementing policies and funding programs to encourage the adoption of health information technologies. These initiatives often include support for the development and integration of medical terminology software, which is essential for effective health data management. For instance, Brazil's Ministry of Health has launched programs to enhance digital health infrastructure, which is expected to boost the medical terminology-software market significantly. Such government backing is likely to foster innovation and increase market penetration.