Cultural and Language Affinity

Cultural and language affinity plays a crucial role in the medical tourism market in South America. Many patients from neighboring countries find it easier to navigate healthcare systems due to shared languages and cultural similarities. This familiarity can reduce anxiety and enhance the overall experience for medical tourists. In 2025, it is estimated that around 25% of medical tourists will choose South America for these reasons, particularly from Spanish-speaking countries. The ability to communicate effectively with healthcare providers can lead to better patient outcomes and satisfaction. As a result, the medical tourism market in South America is likely to see continued growth, driven by these cultural connections.

Quality of Healthcare Services

The medical tourism market in South America benefits from a reputation for high-quality healthcare services. Many hospitals and clinics in countries such as Colombia and Chile are accredited by international organizations, ensuring that they meet rigorous standards. The presence of highly trained medical professionals, often educated in the U.S. or Europe, enhances the appeal of these services. In 2025, it is projected that approximately 30% of medical tourists will prioritize quality over cost when choosing a destination. This focus on quality is likely to bolster the medical tourism market, as patients seek assurance of safety and efficacy in their treatments. The combination of advanced technology and skilled practitioners positions South America as a competitive player in the global medical tourism landscape.

Cost-Effectiveness of Treatments

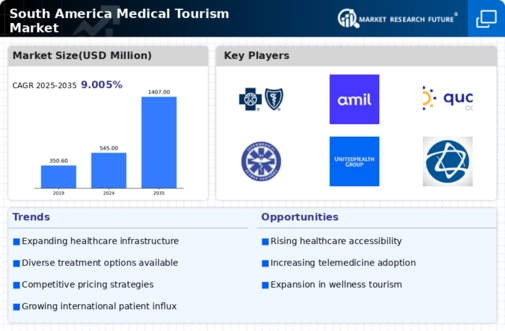

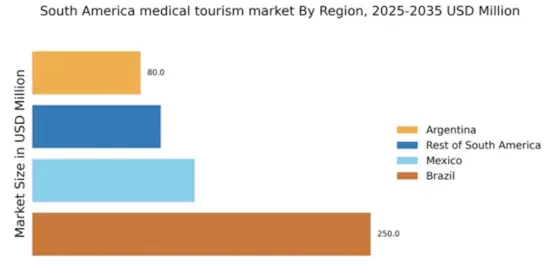

The medical tourism market in South America is significantly driven by the cost-effectiveness of medical treatments. Patients from North America and Europe often find that procedures in countries like Brazil and Argentina can be up to 70% cheaper than in their home countries. This price disparity is particularly evident in elective surgeries and cosmetic procedures, which are highly sought after. The affordability of healthcare services, combined with high-quality medical care, attracts a growing number of international patients. In 2025, it is estimated that the medical tourism market in South America could reach a valuation of $5 billion, largely fueled by this cost advantage. As healthcare costs continue to rise in developed nations, the appeal of South America as a destination for affordable medical care is likely to increase.

Government Support and Regulation

Government support and regulation are pivotal in shaping the medical tourism market in South America. Many governments are actively promoting their countries as medical tourism destinations through marketing campaigns and incentives for healthcare providers. For instance, Brazil has implemented policies to streamline the visa process for medical tourists, making it easier for them to access care. In 2025, it is anticipated that government initiatives could contribute to a 15% increase in medical tourism arrivals. This proactive approach not only enhances the visibility of South American countries but also ensures that healthcare facilities adhere to international standards, thereby boosting confidence among potential medical tourists.

Technological Advancements in Healthcare

Technological advancements in healthcare are transforming the medical tourism market in South America. The integration of cutting-edge medical technologies, such as robotic surgery and telemedicine, enhances the quality and efficiency of care. Countries like Argentina and Brazil are investing in state-of-the-art facilities that attract international patients seeking innovative treatments. In 2025, it is projected that the adoption of new technologies could lead to a 20% increase in the number of medical tourists. This trend indicates that as South American countries continue to modernize their healthcare systems, they may become increasingly appealing to those seeking advanced medical solutions.