Adoption of IoT Technologies

The proliferation of Internet of Things (IoT) devices in South America is a key driver for the micro mobile-data-center market. As industries increasingly adopt IoT technologies, the need for efficient data management and processing solutions becomes critical. Micro mobile data centers offer the flexibility and scalability required to handle the vast amounts of data generated by IoT devices. By 2025, it is anticipated that the number of IoT devices in the region will exceed 1 billion, creating a substantial demand for localized data processing capabilities. This trend suggests that businesses will increasingly rely on micro mobile data centers to ensure seamless data flow and real-time analytics.

Rising Need for Mobile Data Processing

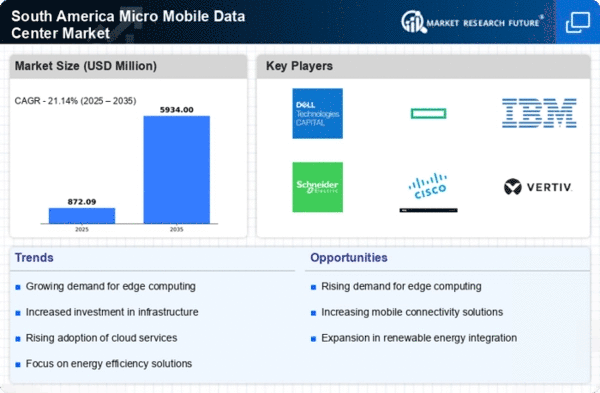

The micro mobile-data-center market in South America is experiencing a notable surge in demand for mobile data processing solutions. This trend is driven by the increasing reliance on real-time data analytics across various sectors, including finance, healthcare, and logistics. As businesses seek to enhance operational efficiency, the need for localized data processing becomes paramount. In 2025, the market is projected to grow by approximately 15%, reflecting the urgency for organizations to adopt mobile data centers that can be deployed rapidly in response to changing business needs. This growth indicates a shift towards more agile IT infrastructures, which are essential for maintaining competitive advantages in a fast-paced digital landscape.

Growing Interest in Hybrid Cloud Solutions

The micro mobile-data-center market in South America is witnessing a growing interest in hybrid cloud solutions. As businesses seek to balance the benefits of public and private cloud environments, micro mobile data centers offer a viable option for integrating these systems. This hybrid approach allows organizations to maintain control over sensitive data while leveraging the scalability of cloud services. By 2025, it is projected that the hybrid cloud market will account for 30% of total cloud adoption in the region, driving demand for micro mobile data centers that facilitate this integration. This trend suggests a shift towards more flexible IT strategies that can adapt to evolving business needs.

Expansion of Telecommunications Infrastructure

The micro mobile-data-center market in South America is significantly influenced by the ongoing expansion of telecommunications infrastructure. As countries invest in enhancing their connectivity, the demand for mobile data centers is likely to increase. Improved network coverage facilitates the deployment of micro mobile data centers, enabling businesses to leverage high-speed internet for data processing and storage. In 2025, it is estimated that investments in telecommunications will reach $10 billion, further propelling the micro mobile-data-center market. This expansion not only supports urban areas but also extends to rural regions, thereby bridging the digital divide and fostering economic growth.

Increased Focus on Disaster Recovery Solutions

The micro mobile-data-center market in South America is also driven by an increased focus on disaster recovery solutions. Organizations are recognizing the importance of having robust backup systems in place to mitigate the risks associated with data loss due to natural disasters or cyber threats. Micro mobile data centers provide a portable and resilient solution for data recovery, allowing businesses to maintain continuity in operations. In 2025, the market for disaster recovery solutions is expected to grow by 20%, indicating a strong demand for mobile data centers that can be deployed quickly in emergency situations. This trend highlights the critical role of micro mobile data centers in enhancing organizational resilience.