Growing Awareness of Gut Health

The increasing awareness of gut health among the South American population is driving the microbiome sequencing-services market. Consumers are becoming more informed about the role of gut microbiota in overall health, leading to a surge in demand for microbiome analysis. This trend is reflected in the rising number of health and wellness products that emphasize gut health, which has seen a growth rate of approximately 15% annually. As individuals seek personalized insights into their microbiomes, the microbiome sequencing-services market is likely to expand, with more companies offering tailored solutions to meet consumer needs.

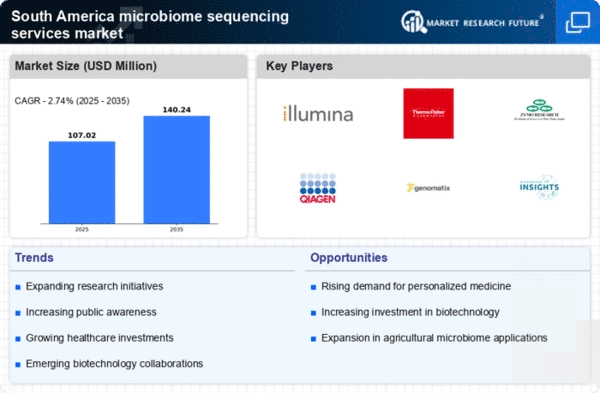

Expansion of Research Institutions

The proliferation of research institutions dedicated to microbiome studies in South America is a significant driver for the microbiome sequencing-services market. These institutions are increasingly focusing on understanding the complex interactions between microbiomes and health, leading to a higher demand for sequencing services. In recent years, funding for microbiome research has increased, with government and private sectors investing over $100 million in various projects. This influx of resources is expected to enhance the capabilities of the microbiome sequencing-services market, fostering innovation and collaboration among researchers.

Government Support for Biotechnology

Government initiatives aimed at promoting biotechnology in South America are fostering growth in the microbiome sequencing-services market. Various countries are implementing policies to support research and development in the life sciences, including microbiome studies. This support is reflected in increased funding opportunities and tax incentives for biotech companies, which are likely to enhance the capabilities of the microbiome sequencing-services market. As governments prioritize health innovation, the market is expected to expand, with more resources allocated to microbiome research and its applications in healthcare.

Rising Incidence of Chronic Diseases

The escalating incidence of chronic diseases in South America is propelling the microbiome sequencing-services market. Conditions such as obesity, diabetes, and inflammatory bowel diseases are becoming more prevalent, prompting healthcare providers to explore microbiome analysis as a potential diagnostic tool. Studies indicate that the microbiome may play a crucial role in the development and management of these diseases, leading to a projected market growth of 20% in the coming years. Consequently, the microbiome sequencing-services market is likely to witness increased demand as healthcare professionals seek to leverage microbiome data for better patient outcomes.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is significantly influencing the microbiome sequencing-services market. Innovations such as artificial intelligence and machine learning are being utilized to analyze microbiome data more effectively, providing deeper insights into health and disease. This technological evolution is expected to enhance the accuracy and efficiency of microbiome sequencing services, attracting more healthcare providers to adopt these solutions. As a result, the microbiome sequencing-services market is poised for growth, with an anticipated increase in service offerings and improved patient care solutions.