Rising Healthcare Expenditure

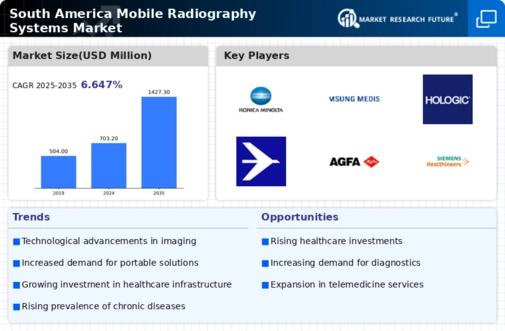

The mobile radiography-systems market in South America is likely to benefit from the increasing healthcare expenditure across various countries in the region. Governments and private sectors are investing more in healthcare infrastructure, which includes advanced diagnostic equipment. For instance, Brazil's healthcare spending has seen a rise of approximately 10% annually, indicating a growing commitment to improving medical services. This trend suggests that hospitals and clinics are more inclined to adopt mobile radiography systems to enhance patient care and operational efficiency. As healthcare budgets expand, the demand for innovative solutions, such as mobile radiography systems, is expected to grow, thereby driving market expansion.

Aging Population and Chronic Diseases

The demographic shift towards an aging population in South America is a significant driver for the mobile radiography-systems market. As the population ages, the prevalence of chronic diseases, such as cardiovascular conditions and respiratory disorders, is likely to increase. This demographic trend necessitates more frequent diagnostic imaging, which mobile radiography systems can provide efficiently. Reports indicate that by 2030, the elderly population in South America could reach 15% of the total population, creating a substantial demand for accessible and portable imaging solutions. Consequently, healthcare providers are expected to invest in mobile radiography systems to cater to this growing patient demographic.

Increased Focus on Patient-Centric Care

The shift towards patient-centric care in South America is influencing the mobile radiography-systems market. Healthcare providers are increasingly prioritizing patient comfort and convenience, which mobile radiography systems can offer through their portability and ease of use. This trend is particularly relevant in rural and underserved areas where access to traditional imaging facilities may be limited. By providing on-site imaging services, mobile radiography systems enhance patient experience and satisfaction. As healthcare systems continue to evolve towards more patient-focused models, the demand for mobile radiography solutions is expected to rise, further propelling market growth.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is transforming the mobile radiography-systems market in South America. Innovations such as artificial intelligence (AI) and cloud computing are enhancing the capabilities of mobile radiography systems, making them more efficient and user-friendly. For example, AI can assist in image analysis, reducing the time required for diagnosis. The market for AI in medical imaging is projected to grow at a CAGR of 30% over the next five years, indicating a strong trend towards technological adoption. This integration not only improves diagnostic accuracy but also streamlines workflows in healthcare facilities, thereby driving the demand for mobile radiography systems.

Regulatory Support for Medical Innovations

Regulatory bodies in South America are increasingly supporting the adoption of innovative medical technologies, including mobile radiography systems. Initiatives aimed at streamlining the approval process for new medical devices are likely to encourage manufacturers to introduce advanced mobile imaging solutions. For instance, Brazil's National Health Surveillance Agency (ANVISA) has implemented measures to expedite the registration of innovative medical technologies. This regulatory support is crucial for fostering a conducive environment for market growth. As more mobile radiography systems gain approval, healthcare providers will have greater access to cutting-edge diagnostic tools, thereby enhancing the overall quality of care in the region.