Rising Geriatric Population

The increasing geriatric population in the US is a crucial driver for the mobile radiography-systems market. As individuals age, they often require more frequent medical imaging services due to various health conditions. According to the US Census Bureau, the population aged 65 and older is projected to reach 80 million by 2040, representing a significant segment of the healthcare market. This demographic shift necessitates the need for mobile radiography systems that can provide timely and efficient imaging services, particularly in home healthcare settings. The convenience and accessibility offered by mobile systems align with the growing demand for patient-centered care, thereby enhancing the overall efficiency of healthcare delivery. Consequently, the mobile radiography-systems market is likely to experience substantial growth as healthcare providers adapt to the needs of an aging population.

Rising Healthcare Expenditure

The upward trajectory of healthcare expenditure in the US is a pivotal driver for the mobile radiography-systems market. With healthcare spending projected to reach $6 trillion by 2027, there is a growing investment in advanced medical technologies, including mobile imaging systems. This increase in funding allows healthcare facilities to upgrade their equipment and improve service delivery. Furthermore, as hospitals and clinics strive to enhance patient care and operational efficiency, the demand for mobile radiography systems is expected to rise. The mobile radiography-systems market stands to benefit from this trend, as healthcare providers seek to leverage innovative solutions that align with their financial capabilities and patient care objectives.

Technological Innovations in Imaging

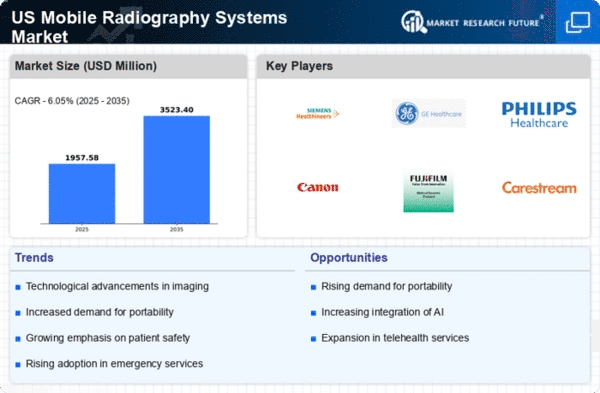

Technological advancements in imaging modalities are propelling the mobile radiography-systems market forward. Innovations such as digital radiography and portable X-ray machines have significantly improved image quality and reduced radiation exposure. The integration of artificial intelligence (AI) in imaging systems is also enhancing diagnostic accuracy and workflow efficiency. As of 2025, the market for digital radiography is expected to grow at a CAGR of approximately 6.5%, indicating a robust demand for advanced imaging solutions. These innovations not only improve patient outcomes but also streamline operations within healthcare facilities. The mobile radiography-systems market is thus positioned to benefit from these technological trends, as healthcare providers seek to adopt state-of-the-art equipment that meets the evolving needs of patients and practitioners alike.

Expansion of Home Healthcare Services

The expansion of home healthcare services is significantly influencing the mobile radiography-systems market. As more patients prefer receiving care in the comfort of their homes, healthcare providers are increasingly adopting mobile imaging solutions to meet this demand. The home healthcare market is projected to grow at a CAGR of around 8% through 2027, driven by factors such as an aging population and advancements in telehealth. Mobile radiography systems facilitate timely imaging without the need for patient transport, thereby improving patient satisfaction and outcomes. This trend indicates a shift towards more personalized healthcare delivery, positioning the mobile radiography-systems market for substantial growth as providers adapt to the evolving landscape of patient care.

Increased Focus on Emergency Services

The heightened emphasis on emergency medical services is a significant driver for the mobile radiography-systems market. Emergency departments are increasingly utilizing mobile radiography systems to expedite diagnosis and treatment in critical situations. The ability to perform imaging at the bedside reduces patient transport time and enhances overall care efficiency. In 2025, it is estimated that emergency medical services will account for a substantial portion of the healthcare budget, with expenditures reaching approximately $50 billion. This trend underscores the necessity for mobile radiography systems that can deliver rapid imaging solutions in emergency settings. As healthcare providers prioritize quick and effective responses to emergencies, the mobile radiography-systems market is likely to see increased adoption and investment.