Regulatory Framework Enhancements

The montelukast intermediate market is currently benefiting from enhancements in the regulatory framework governing pharmaceutical production in South America. Recent reforms have streamlined the approval processes for new medications and intermediates, thereby facilitating quicker market entry for manufacturers. This regulatory support is crucial for companies looking to introduce montelukast intermediates, as it reduces the time and costs associated with compliance. Furthermore, the establishment of clear guidelines for quality assurance and safety standards is likely to bolster consumer confidence in locally produced medications. As a result, the montelukast intermediate market may experience accelerated growth, as manufacturers are better equipped to meet both domestic and international demand for high-quality products.

Technological Advancements in Production

Technological advancements in production processes are poised to have a transformative impact on the montelukast intermediate market in South America. Innovations such as continuous manufacturing and process optimization are enabling companies to enhance efficiency and reduce production costs. These advancements may lead to a more sustainable production model, which is increasingly important in today's environmentally conscious market. As manufacturers adopt these technologies, the quality and consistency of montelukast intermediates are expected to improve, thereby meeting the stringent requirements of regulatory bodies. This shift towards modernized production techniques could potentially position the montelukast intermediate market for significant growth, as companies strive to remain competitive in an evolving landscape.

Rising Awareness of Preventive Healthcare

There appears to be a growing awareness of preventive healthcare measures among the South American population, which is positively influencing the montelukast intermediate market. As individuals become more informed about the benefits of managing respiratory conditions proactively, the demand for montelukast as a preventive treatment option is likely to increase. Educational campaigns and community health initiatives are playing a crucial role in disseminating information about asthma management and the importance of medication adherence. Consequently, this heightened awareness may lead to an uptick in prescriptions for montelukast, thereby driving growth in the intermediate market. The potential for increased patient engagement in their health management could further solidify the position of montelukast as a preferred choice for asthma control.

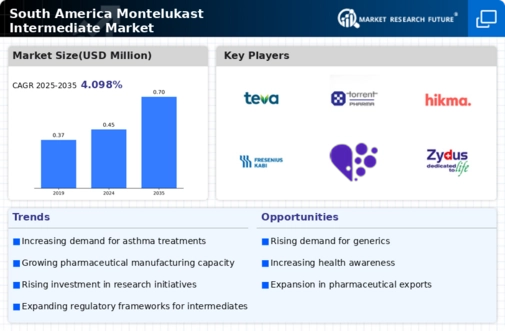

Investment in Pharmaceutical Manufacturing

The montelukast intermediate market in South America is witnessing a surge in investment aimed at enhancing local pharmaceutical manufacturing capabilities. Governments and private investors are increasingly recognizing the potential for economic growth through the production of essential medications. For instance, recent initiatives have allocated over $100 million towards the establishment of state-of-the-art manufacturing facilities. This investment not only aims to reduce dependency on imports but also to ensure a steady supply of montelukast intermediates. As local production ramps up, it is anticipated that the montelukast intermediate market will benefit from reduced costs and improved accessibility for healthcare providers and patients alike. This trend may also foster innovation within the industry, as companies strive to enhance their production processes and product offerings.

Increasing Prevalence of Allergic Conditions

The montelukast intermediate market in South America is likely experiencing growth due to the rising prevalence of allergic conditions such as asthma and allergic rhinitis. Reports indicate that approximately 20% of the population in urban areas suffers from asthma, which necessitates effective treatment options. This increasing incidence of respiratory disorders is driving demand for montelukast, a key medication in managing these conditions. As healthcare providers seek to offer effective solutions, the montelukast intermediate market is positioned to benefit from this trend, as manufacturers ramp up production to meet the growing needs of patients. Furthermore, the emphasis on early diagnosis and treatment in South America is expected to further bolster the market, as more individuals seek medical intervention for their allergic conditions.