Government Initiatives and Funding

Government initiatives and funding aimed at combating liver diseases are expected to bolster the non alcoholic-steatohepatitis-biomarkers market in South America. Various health authorities are recognizing the economic burden posed by liver diseases and are allocating resources for research and public health programs. This support may include grants for biomarker research, subsidies for diagnostic tools, and funding for awareness campaigns. Such initiatives could enhance collaboration between public and private sectors, fostering innovation in biomarker development. The financial backing from governments is likely to accelerate the introduction of new biomarkers into the market, thereby improving diagnostic capabilities and patient management.

Increasing Awareness of Liver Health

The growing awareness regarding liver health in South America is driving the non alcoholic-steatohepatitis-biomarkers market. Public health campaigns and educational initiatives are emphasizing the importance of liver function and the risks associated with non alcoholic fatty liver disease (NAFLD). This heightened awareness is likely to lead to increased screening and diagnostic testing, thereby boosting demand for biomarkers. As a result, healthcare providers are more inclined to invest in advanced diagnostic tools, which could potentially enhance patient outcomes. The market for liver health diagnostics is projected to grow at a CAGR of approximately 8% over the next few years, indicating a robust opportunity for stakeholders in the non alcoholic-steatohepatitis-biomarkers market.

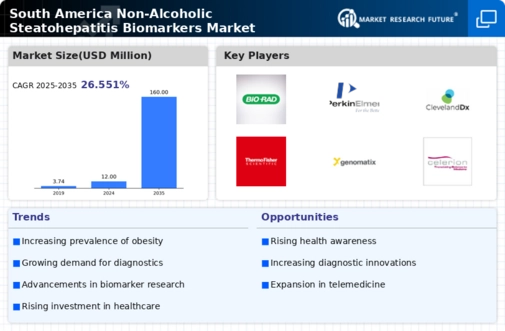

Rising Incidence of Metabolic Disorders

The rising incidence of metabolic disorders, including diabetes and obesity, is significantly impacting the non alcoholic-steatohepatitis-biomarkers market in South America. As these conditions become more prevalent, the risk of developing non alcoholic steatohepatitis (NASH) increases, leading to a greater need for effective biomarkers for early detection and monitoring. Recent studies suggest that nearly 30% of the adult population in certain South American countries may be affected by obesity, which is a major risk factor for NASH. This trend is likely to drive investments in biomarker research and development, as healthcare systems seek to address the growing burden of metabolic diseases and their associated complications.

Growing Demand for Personalized Medicine

The growing demand for personalized medicine is influencing the non alcoholic-steatohepatitis-biomarkers market in South America. As healthcare shifts towards tailored treatment approaches, the need for specific biomarkers that can guide therapy decisions is becoming increasingly apparent. Personalized medicine allows for more effective management of non alcoholic steatohepatitis by identifying patients who are most likely to benefit from particular interventions. This trend is expected to drive research into novel biomarkers and their applications in clinical settings. The market for personalized medicine is projected to expand significantly, with estimates suggesting a growth rate of approximately 12% over the next few years, indicating a promising landscape for the non alcoholic-steatohepatitis-biomarkers market.

Technological Advancements in Diagnostic Tools

Technological advancements in diagnostic tools are playing a crucial role in shaping the non alcoholic-steatohepatitis-biomarkers market. Innovations such as non-invasive imaging techniques and advanced blood tests are enhancing the ability to detect and monitor liver diseases. These developments are likely to reduce the need for invasive liver biopsies, making diagnosis more accessible and less risky for patients. The integration of artificial intelligence and machine learning in data analysis is also expected to improve the accuracy of biomarker identification. As a result, the market is anticipated to witness a surge in demand for these advanced diagnostic solutions, potentially leading to a market growth rate of around 10% in the coming years.