Rising Focus on Personalized Medicine

The increasing emphasis on personalized medicine is shaping the landscape of the non alcoholic-steatohepatitis-biomarkers market. As healthcare moves towards tailored treatment approaches, the need for specific biomarkers that can predict individual responses to therapies becomes paramount. In the US, the shift towards personalized medicine is supported by advancements in genomics and proteomics, which enable the identification of unique biomarkers associated with NASH. This trend is likely to enhance the development of targeted therapies and improve patient outcomes. Consequently, the non alcoholic-steatohepatitis-biomarkers market is expected to benefit from this focus on personalized approaches, as stakeholders seek to develop biomarkers that align with the principles of individualized care.

Growing Incidence of Metabolic Disorders

The rising incidence of metabolic disorders, particularly obesity and type 2 diabetes, is a crucial driver for the non alcoholic-steatohepatitis-biomarkers market. In the US, approximately 42.4% of adults are classified as obese, which significantly increases the risk of developing non alcoholic fatty liver disease (NAFLD) and its more severe form, non alcoholic steatohepatitis (NASH). This alarming trend necessitates the development of effective biomarkers for early diagnosis and monitoring of liver health. As healthcare providers seek to address the growing burden of these metabolic conditions, the demand for reliable biomarkers is expected to surge, thereby propelling the growth of the non alcoholic-steatohepatitis-biomarkers market. Furthermore, the increasing healthcare costs associated with managing these disorders further emphasize the need for early detection and intervention.

Regulatory Support for Biomarker Development

Regulatory bodies in the US are increasingly recognizing the importance of biomarkers in the diagnosis and management of liver diseases, including NASH. The FDA has established pathways to expedite the approval of novel biomarkers, which is likely to enhance the non alcoholic-steatohepatitis-biomarkers market. Initiatives such as the Biomarker Qualification Program aim to facilitate the development and validation of biomarkers, thereby streamlining the process for researchers and companies. This regulatory support not only encourages innovation but also instills confidence in stakeholders regarding the efficacy and safety of new biomarkers. As a result, the non alcoholic-steatohepatitis-biomarkers market is poised for growth, driven by a favorable regulatory environment that promotes the introduction of advanced diagnostic tools.

Growing Demand for Non-Invasive Diagnostic Tools

The demand for non-invasive diagnostic tools is rapidly increasing in the healthcare landscape, particularly for liver diseases. Patients and healthcare providers are increasingly favoring non-invasive methods over traditional liver biopsies due to their associated risks and discomfort. This shift in preference is driving the non alcoholic-steatohepatitis-biomarkers market, as new biomarkers are being developed to facilitate non-invasive assessments of liver health. Technologies such as imaging techniques and blood-based biomarkers are gaining traction, offering reliable alternatives for diagnosing NASH. As awareness of the benefits of non-invasive diagnostics continues to grow, the market for non alcoholic-steatohepatitis-biomarkers is likely to experience significant growth, catering to the evolving needs of patients and clinicians.

Increased Investment in Research and Development

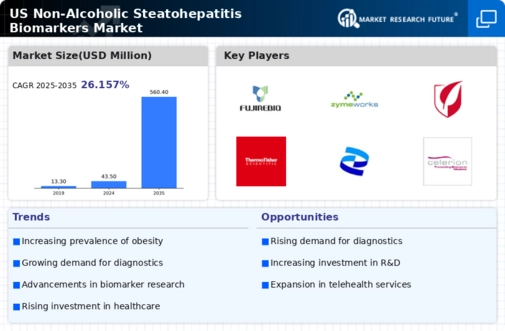

Investment in research and development (R&D) for liver diseases is witnessing a notable increase, which serves as a significant driver for the non alcoholic-steatohepatitis-biomarkers market. Pharmaceutical companies and research institutions are allocating substantial resources to discover and validate new biomarkers that can aid in the diagnosis and treatment of NASH. In 2025, it is estimated that R&D spending in the healthcare sector will reach approximately $200 billion in the US, with a considerable portion directed towards liver disease research. This influx of funding is likely to accelerate the pace of biomarker discovery, leading to innovative solutions that address the unmet needs in the management of NASH. Consequently, the non alcoholic-steatohepatitis-biomarkers market is expected to expand as new biomarkers are developed and brought to market.