Rising Geriatric Population

The growing geriatric population in South America is a significant driver for the occlusion devices market. As individuals age, the risk of developing various health conditions, including cardiovascular diseases, increases. According to demographic studies, the population aged 65 and older is expected to reach 15% of the total population by 2030 in several South American countries. This demographic shift is likely to lead to a higher demand for medical interventions, including occlusion devices, to manage age-related health issues. Healthcare providers are increasingly focusing on tailored solutions for the elderly, which may include specialized occlusion devices designed for this demographic. Consequently, the occlusion devices market is poised for growth as it adapts to the needs of an aging population.

Growing Awareness and Education

The increasing awareness and education regarding occlusion devices among healthcare professionals and patients are driving the market in South America. Educational programs and workshops conducted by medical associations are enhancing knowledge about the benefits and applications of these devices. As healthcare providers become more informed about the latest advancements in occlusion technology, they are more likely to recommend these devices to patients. Furthermore, patient education initiatives are empowering individuals to seek treatment options that include occlusion devices. This heightened awareness is expected to contribute to a growing market, as more patients opt for these innovative solutions. The occlusion devices market is likely to benefit from this trend, as informed patients and healthcare professionals drive demand for effective medical interventions.

Government Initiatives and Funding

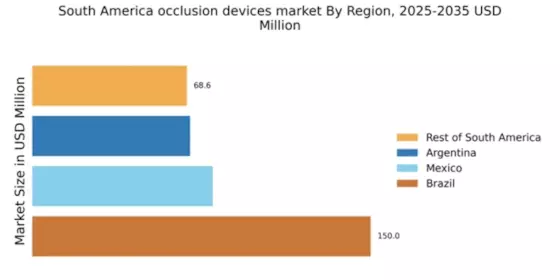

Government initiatives aimed at improving healthcare infrastructure in South America are playing a pivotal role in the growth of the occlusion devices market. Various countries in the region are implementing policies to enhance access to advanced medical technologies, including occlusion devices. Increased funding for healthcare programs and partnerships with private sectors are facilitating the procurement of these devices in hospitals and clinics. For instance, Brazil's government has allocated approximately $500 million for healthcare improvements, which includes investments in medical devices. Such initiatives not only enhance the availability of occlusion devices but also promote awareness among healthcare providers about their benefits. As a result, the occlusion devices market is likely to experience a surge in demand, driven by supportive government policies and funding.

Technological Innovations in Medical Devices

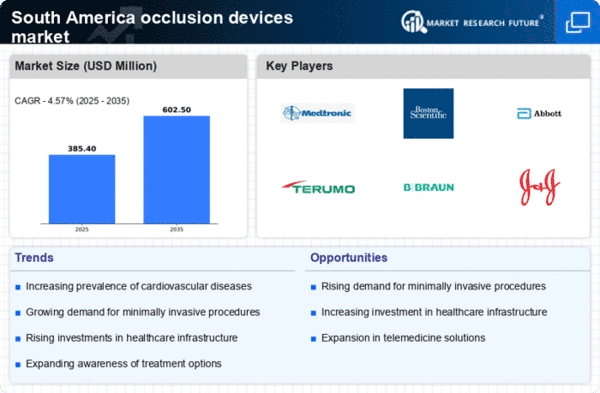

Technological advancements in medical devices are significantly influencing the occlusion devices market in South America. Innovations such as minimally invasive procedures and the development of bioresorbable occlusion devices are gaining traction among healthcare providers. These advancements not only improve patient outcomes but also reduce recovery times, making them more appealing to both patients and medical professionals. The market for occlusion devices is projected to grow at a CAGR of around 8% over the next five years, driven by these technological innovations. Additionally, the integration of digital technologies, such as telemedicine and remote monitoring, is enhancing the efficiency of occlusion devices, further stimulating market growth. As healthcare systems in South America continue to evolve, the demand for cutting-edge occlusion devices is likely to increase, positioning the industry for substantial growth.

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases in South America is a crucial driver for the occlusion devices market. As per recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in the region. This alarming trend necessitates the adoption of advanced medical devices, including occlusion devices, to manage and treat these conditions effectively. The growing awareness among healthcare professionals and patients regarding the benefits of these devices is likely to propel market growth. Furthermore, the increasing number of hospitals and specialized cardiac care centers in urban areas enhances accessibility to these devices, thereby fostering their adoption. The demand for innovative solutions to combat cardiovascular diseases is expected to drive investments in research and development, ultimately benefiting the occlusion devices market in South America.