Growing Aging Population

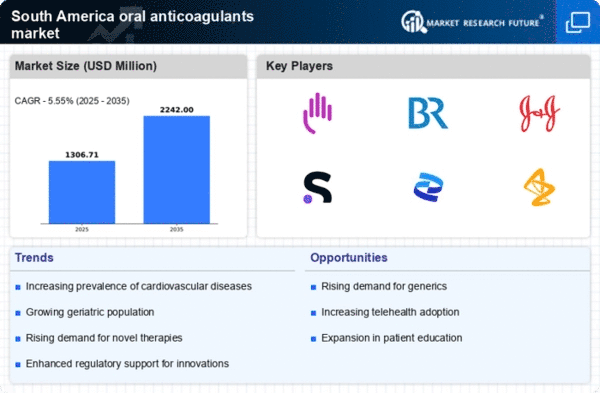

The increasing aging population in South America is a pivotal driver for the oral anticoagulants market. As individuals age, the risk of developing cardiovascular diseases and thromboembolic disorders escalates, necessitating anticoagulant therapies. In 2025, it is estimated that approximately 15% of the South American population will be aged 65 and older, a demographic that typically requires more intensive management of anticoagulation therapy. This demographic shift is likely to propel the demand for oral anticoagulants, as healthcare providers seek effective solutions to manage age-related health issues. Consequently, the oral anticoagulants market is expected to experience substantial growth, driven by the need for preventive and therapeutic measures in this vulnerable population.

Rising Healthcare Expenditure

In South America, rising healthcare expenditure is significantly influencing the oral anticoagulants market. Governments and private sectors are increasingly investing in healthcare infrastructure, which includes the procurement of advanced medications. In 2025, healthcare spending in the region is projected to reach $1.5 trillion, with a notable portion allocated to chronic disease management, including anticoagulation therapy. This financial commitment is likely to enhance access to oral anticoagulants, thereby expanding the market. Furthermore, as healthcare systems evolve, the oral anticoagulants market may witness innovations in drug formulations and delivery methods, catering to the growing demand for effective anticoagulation therapies.

Enhanced Diagnostic Capabilities

The advancement of diagnostic technologies in South America is a crucial driver for the oral anticoagulants market. Improved diagnostic capabilities enable healthcare professionals to identify patients at risk of thromboembolic events more accurately. For instance, the introduction of point-of-care testing and advanced imaging techniques has streamlined the diagnosis of conditions requiring anticoagulation therapy. As a result, the oral anticoagulants market is likely to benefit from an increase in patient identification and subsequent treatment initiation. This trend suggests that as diagnostic tools become more sophisticated, the demand for oral anticoagulants will likely rise, leading to a more proactive approach in managing thromboembolic disorders.

Growing Focus on Preventive Healthcare

The growing emphasis on preventive healthcare in South America is shaping the oral anticoagulants market. With an increasing awareness of the benefits of early intervention, healthcare providers are advocating for the use of anticoagulants in at-risk populations. This shift towards preventive measures is likely to enhance the adoption of oral anticoagulants, particularly among individuals with risk factors such as hypertension and diabetes. In 2025, it is anticipated that preventive healthcare initiatives will account for approximately 30% of healthcare spending in the region. Consequently, the oral anticoagulants market may experience a surge in demand as more patients seek preventive therapies to mitigate the risk of thromboembolic events.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is emerging as a significant driver for the oral anticoagulants market in South America. Regulatory bodies are increasingly streamlining the approval processes for new anticoagulant medications, facilitating quicker access to advanced treatment options. This trend is likely to encourage pharmaceutical companies to invest in research and development, leading to the introduction of novel oral anticoagulants. In 2025, it is expected that the number of approved oral anticoagulants in the region will increase by 20%, reflecting the supportive regulatory environment. As a result, the oral anticoagulants market is poised for growth, driven by the availability of innovative therapies that meet the evolving needs of patients.