Rising Environmental Concerns

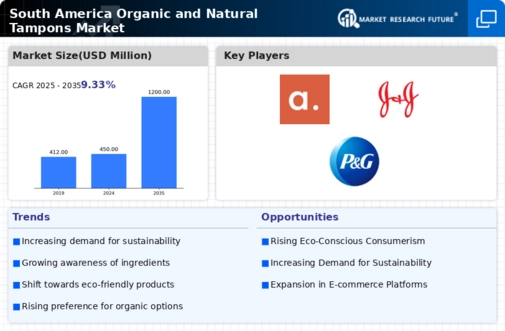

The South America Organic And Natural Tampons Market is experiencing a notable shift driven by increasing environmental concerns among consumers. As awareness of the ecological impact of conventional menstrual products grows, many women are seeking sustainable alternatives. Reports indicate that the demand for organic and natural tampons has surged, with a projected growth rate of approximately 10% annually in the region. This trend is particularly pronounced in urban areas where consumers are more informed about the benefits of eco-friendly products. The South American market is responding to this demand by expanding the availability of organic options, which are often made from biodegradable materials. Consequently, brands that prioritize sustainability are likely to gain a competitive edge, appealing to a demographic that values environmental responsibility.

Government Regulations and Initiatives

The South America Organic And Natural Tampons Market is influenced by government regulations aimed at promoting health and safety standards. Several countries in the region have implemented policies that encourage the use of organic materials in personal care products. For instance, Brazil has introduced guidelines that require manufacturers to disclose the ingredients used in menstrual products, fostering transparency and consumer trust. Such regulations not only enhance product safety but also stimulate market growth by encouraging manufacturers to innovate and offer organic alternatives. The presence of supportive government initiatives is likely to bolster the organic tampon segment, as consumers become more aware of the health implications associated with synthetic materials.

Cultural Shifts Towards Natural Products

Cultural shifts in South America are significantly impacting the Organic And Natural Tampons Market. There is a growing acceptance of natural and organic products, driven by a desire for healthier lifestyles. This cultural transformation is reflected in the increasing popularity of organic tampons, which are perceived as safer and more beneficial for women's health. Market data suggests that sales of organic tampons have increased by over 15% in the last year alone, indicating a robust trend towards natural alternatives. As more women prioritize their health and well-being, brands that align with these values are likely to thrive in the competitive landscape of the South American market.

Influence of Social Media and Influencers

The South America Organic And Natural Tampons Market is being shaped by the influence of social media and digital marketing. Platforms such as Instagram and TikTok have become powerful tools for brands to reach consumers, particularly younger demographics who are more inclined to seek out organic products. Influencers play a crucial role in this dynamic, often promoting the benefits of organic tampons and educating their followers about sustainable practices. This trend has led to a significant increase in brand visibility and consumer engagement, with many companies reporting a rise in sales attributed to social media campaigns. As digital marketing continues to evolve, its impact on the organic tampon market is expected to grow, further driving consumer interest and demand.

Growing Retail Availability and Accessibility

The South America Organic And Natural Tampons Market is benefiting from enhanced retail availability and accessibility of organic products. Traditional retail channels, as well as e-commerce platforms, are increasingly stocking organic and natural tampons, making them more accessible to consumers. Data indicates that online sales of organic tampons have risen by approximately 20% in the past year, reflecting a shift in shopping habits. This increased availability is crucial in meeting the rising demand for organic options, as consumers are more likely to purchase products that are readily accessible. Retailers that prioritize organic offerings are likely to capture a larger market share, as they cater to the growing consumer preference for sustainable and health-conscious products.