Emerging Infectious Diseases

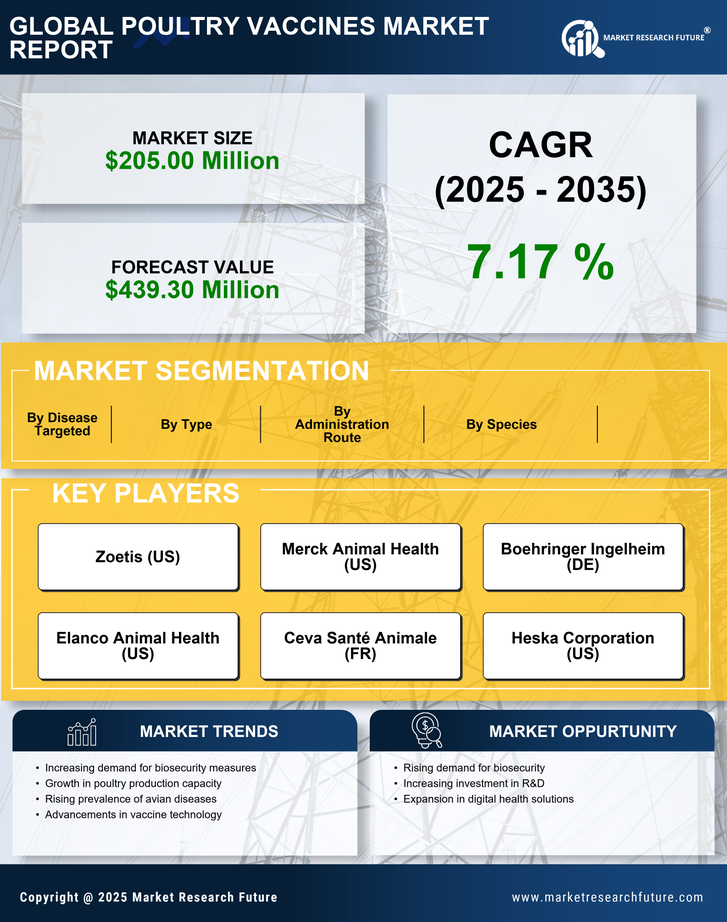

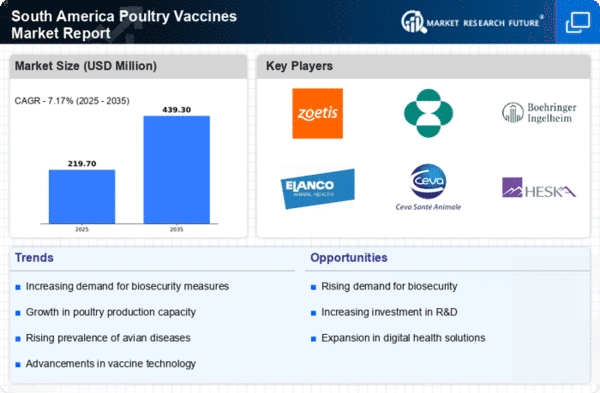

The emergence of new infectious diseases poses a significant challenge to poultry farming in South America. Outbreaks of diseases such as avian influenza and Newcastle disease have been reported, leading to substantial economic losses. The poultry vaccines market is responding to this threat by developing innovative vaccines tailored to combat these specific diseases. In 2025, the market for poultry vaccines is expected to grow by approximately 8% annually, driven by the urgent need for effective disease management solutions. Farmers are increasingly recognizing the importance of vaccination as a preventive measure, which is likely to bolster the demand for vaccines in the region.

Increasing Poultry Production

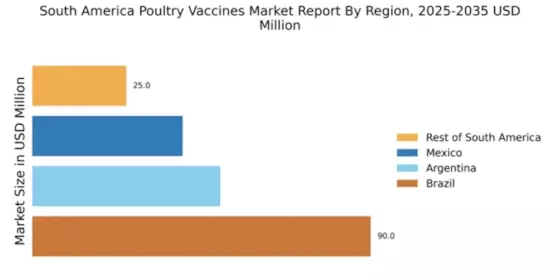

The rising demand for poultry products in South America is driving the poultry vaccines market. As the population grows, the need for protein-rich food sources, particularly chicken, is escalating. In 2025, poultry production in South America is projected to reach approximately 30 million metric tons, indicating a robust growth trajectory. This increase in production necessitates effective vaccination strategies to ensure the health and productivity of poultry flocks. Vaccines play a crucial role in preventing diseases that can significantly impact production levels. Consequently, the poultry vaccines market is likely to experience heightened demand as producers seek to maintain flock health and optimize yield.

Government Support and Subsidies

Government initiatives aimed at enhancing food security and supporting the agricultural sector are influencing the poultry vaccines market in South America. Various countries in the region are implementing policies that provide financial assistance and subsidies to poultry farmers for vaccination programs. This support is crucial in promoting the adoption of vaccines, particularly among smallholder farmers who may lack the resources to invest in health management. In 2025, it is anticipated that government funding for poultry health initiatives will increase by 15%, further stimulating the poultry vaccines market. Such measures not only improve flock health but also contribute to the overall sustainability of poultry production.

Advancements in Vaccine Technology

Technological advancements in vaccine development are reshaping the poultry vaccines market in South America. Innovations such as recombinant vaccines and vector-based vaccines are being introduced, offering enhanced efficacy and safety profiles. These advancements are crucial in addressing the challenges posed by evolving pathogens and improving the overall health of poultry populations. In 2025, the market for advanced vaccine technologies is projected to grow by 12%, reflecting the increasing investment in research and development. As poultry producers seek to adopt the latest technologies to protect their flocks, the demand for innovative vaccines is likely to surge, further propelling the growth of the poultry vaccines market.

Consumer Awareness and Health Trends

There is a growing awareness among consumers regarding food safety and animal welfare in South America. This trend is influencing the poultry vaccines market as consumers demand healthier and safer poultry products. As a result, poultry producers are increasingly investing in vaccination programs to ensure the health of their flocks and meet consumer expectations. In 2025, it is estimated that the demand for antibiotic-free poultry products will rise by 20%, prompting farmers to adopt vaccination as a primary strategy for disease prevention. This shift in consumer preferences is likely to drive the growth of the poultry vaccines market as producers seek to align their practices with market demands.