Expansion of Product Varieties

The expansion of product varieties within the sexual lubricants market is another significant driver. Manufacturers are increasingly introducing diverse formulations, including organic, flavored, and silicone-based lubricants, catering to a broader range of consumer preferences. This diversification is likely to attract new customers and retain existing ones, as individuals seek products that align with their personal values and desires. Recent market analysis indicates that flavored lubricants have seen a 30% increase in sales, reflecting a growing interest in enhancing sexual experiences. The continuous innovation in product offerings is expected to sustain growth in the market.

Cultural Shifts Towards Openness

Cultural shifts towards greater openness regarding sexual topics in South America are influencing the sexual lubricants market. As societal norms evolve, discussions surrounding sexual health and pleasure are becoming more mainstream. This cultural transformation is likely to reduce stigma associated with purchasing and using sexual lubricants. Market analysts suggest that this shift could lead to a 20% increase in product adoption among younger demographics, who are more inclined to embrace these products. As acceptance grows, manufacturers may find new opportunities to innovate and market their products effectively, further propelling the industry forward.

Increased Focus on Personal Care

The heightened focus on personal care and wellness in South America is contributing to the growth of the sexual lubricants market. As consumers prioritize self-care routines, products that enhance sexual pleasure are gaining traction. This trend is likely to be fueled by the increasing availability of sexual wellness products in mainstream retail outlets. Market data suggests that the personal care segment, which includes sexual lubricants, is projected to grow by 18% over the next five years. This focus on personal well-being is expected to drive demand for lubricants, as consumers seek to enhance their intimate experiences.

Influence of E-commerce Platforms

The rise of e-commerce platforms in South America is transforming the purchasing landscape for the sexual lubricants market. Consumers are increasingly turning to online shopping for convenience and privacy, which has led to a significant uptick in online sales. Recent statistics suggest that online sales of sexual lubricants have grown by 25% in the last year alone. This trend is likely to continue as more consumers prefer the discretion that online shopping offers. Additionally, the availability of a wider range of products online allows consumers to explore various options, thereby driving market growth. The shift towards digital retail channels is expected to play a crucial role in shaping the future of the sexual lubricants market.

Growing Awareness of Sexual Health

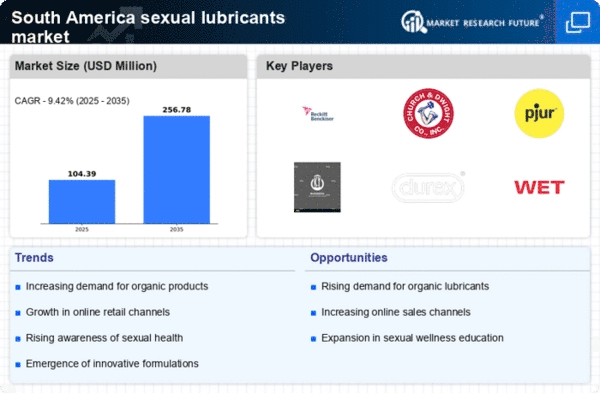

The increasing awareness of sexual health in South America appears to be a pivotal driver for the sexual lubricants market. Educational campaigns and initiatives by health organizations have contributed to a more informed public regarding sexual wellness. This heightened awareness is likely to lead to a greater acceptance of sexual lubricants as essential products for enhancing sexual experiences. Market data indicates that the demand for lubricants has surged, with a notable increase of approximately 15% in sales over the past year. As consumers become more educated about the benefits of using lubricants, the market is expected to expand further, potentially reaching a valuation of $200 million by 2026.