Technological Integration in Healthcare

The integration of advanced technologies in healthcare is transforming the smart inhalers market. In South America, the adoption of digital health solutions is on the rise, with a reported increase of 25% in telehealth services over the past few years. Smart inhalers, which utilize mobile applications and cloud-based platforms, enable real-time data tracking and personalized treatment plans. This technological shift not only enhances patient outcomes but also streamlines healthcare delivery. As healthcare providers increasingly recognize the benefits of technology in managing chronic diseases, the demand for smart inhalers is expected to grow, reflecting a broader trend towards digital health solutions in the region.

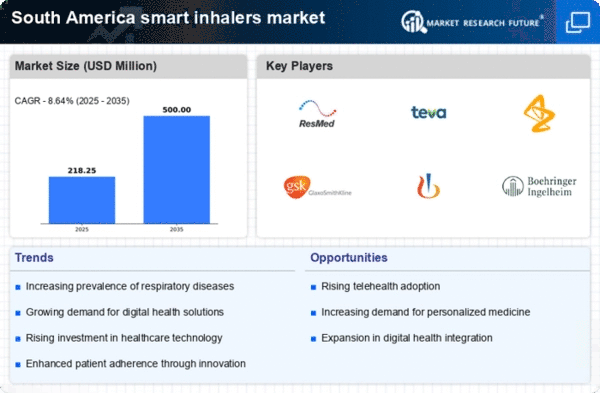

Rising Prevalence of Respiratory Diseases

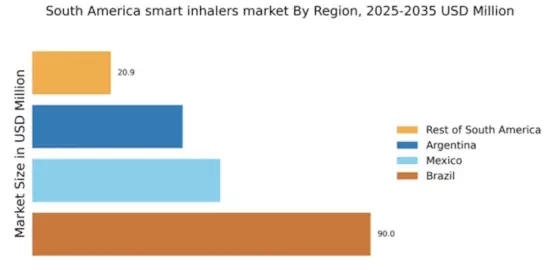

The increasing incidence of respiratory diseases in South America is a primary driver for the smart inhalers market. Conditions such as asthma and chronic obstructive pulmonary disease (COPD) are becoming more prevalent, affecting millions. According to health statistics, approximately 10% of the population in countries like Brazil and Argentina suffers from asthma, which necessitates effective management solutions. Smart inhalers, equipped with digital technology, offer enhanced monitoring and adherence features, which are crucial for managing these chronic conditions. The growing awareness of respiratory health and the need for innovative treatment options are likely to propel the demand for smart inhalers in the region, thereby expanding the market significantly.

Growing Investment in Healthcare Innovation

Investment in healthcare innovation is a crucial driver for the smart inhalers market in South America. Venture capital funding for health tech startups has surged, with an estimated $200 million invested in digital health solutions in the last year alone. This influx of capital is fostering the development of innovative smart inhalers that incorporate features such as adherence tracking and data analytics. As investors recognize the potential of smart inhalers to improve patient outcomes and reduce healthcare costs, the market is likely to experience accelerated growth. The emphasis on innovation in healthcare is expected to create a competitive landscape, further propelling the smart inhalers market.

Increased Awareness of Medication Adherence

The growing awareness of the importance of medication adherence is driving the smart inhalers market in South America. Studies indicate that nearly 50% of patients with chronic respiratory conditions do not adhere to their prescribed treatment regimens. Smart inhalers, designed to provide reminders and track usage, are becoming essential tools in addressing this issue. Educational campaigns by health organizations are highlighting the benefits of adherence, which is likely to increase the adoption of smart inhalers among patients. As awareness continues to rise, the market for these devices is expected to expand, reflecting a shift towards more effective management of respiratory diseases.

Government Initiatives for Chronic Disease Management

Government initiatives aimed at improving chronic disease management are significantly influencing the smart inhalers market. In South America, various health ministries are implementing programs to enhance access to respiratory care, which includes the promotion of smart inhalers. For instance, Brazil's Ministry of Health has allocated over $50 million to improve asthma management through innovative technologies. Such initiatives are likely to increase awareness and accessibility of smart inhalers, encouraging patients to adopt these advanced devices. As public health policies evolve to support chronic disease management, the smart inhalers market is poised for growth, driven by increased government support and funding.