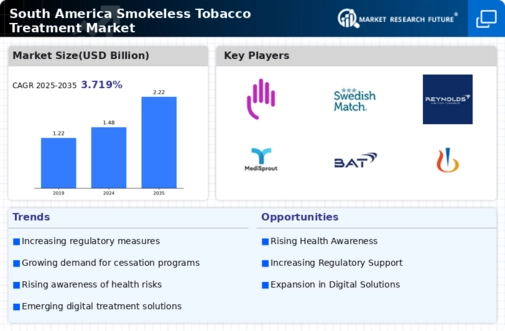

Rising Health Concerns

The increasing awareness of health risks associated with smokeless tobacco use is a primary driver in the smokeless tobacco-treatment market. In South America, studies indicate that nearly 30% of users are concerned about the long-term health effects, which include oral cancers and cardiovascular diseases. This growing apprehension is prompting individuals to seek treatment options, thereby expanding the market. Furthermore, public health campaigns aimed at educating the population about the dangers of smokeless tobacco are gaining traction, leading to a shift in consumer behavior. As a result, the smokeless tobacco-treatment market is likely to experience a surge in demand for cessation products and services.

Government Initiatives and Support

Government initiatives aimed at reducing tobacco consumption are significantly influencing the smokeless tobacco-treatment market. In South America, various countries have implemented policies that promote cessation programs and provide funding for public health campaigns. For instance, Brazil has allocated approximately $50 million annually to support anti-tobacco initiatives. These efforts not only raise awareness but also facilitate access to treatment options for users. The smokeless tobacco-treatment market is thus benefiting from these supportive measures, as they encourage individuals to seek help and reduce their dependency on smokeless tobacco.

Technological Advancements in Treatment

Technological advancements are reshaping the smokeless tobacco-treatment market, particularly in South America. Innovations such as mobile health applications and telemedicine services are making it easier for users to access treatment and support. For example, a recent survey revealed that 40% of users prefer digital platforms for receiving guidance on cessation methods. This trend indicates a shift towards more personalized and accessible treatment options. Consequently, the smokeless tobacco-treatment market is likely to expand as these technologies become more integrated into cessation strategies, appealing to a broader audience.

Cultural Shifts and Changing Social Norms

Cultural shifts in attitudes towards smokeless tobacco are driving changes in the smokeless tobacco-treatment market. In South America, there is a noticeable decline in the social acceptance of tobacco use, particularly among younger generations. This change is fostering a more health-conscious environment, where individuals are increasingly motivated to quit. Surveys indicate that approximately 25% of users are actively seeking treatment options due to changing social norms. As these cultural dynamics evolve, the smokeless tobacco-treatment market is expected to grow, reflecting the changing landscape of tobacco consumption.

Increased Availability of Treatment Options

The growing availability of diverse treatment options is a crucial driver in the smokeless tobacco-treatment market. In South America, there has been a notable increase in the number of clinics and programs dedicated to tobacco cessation. Reports suggest that the number of treatment facilities has risen by 15% over the past three years. This expansion provides users with more choices, including counseling, pharmacotherapy, and support groups. As a result, the smokeless tobacco-treatment market is likely to see an uptick in participation rates, as individuals find it easier to access the help they need.