Increasing Health Awareness

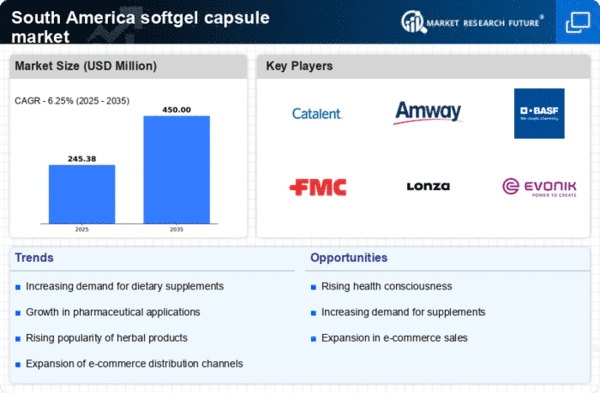

The softgel capsule market in South America is experiencing growth driven by a notable increase in health awareness among consumers. As individuals become more conscious of their health and wellness, there is a rising demand for dietary supplements that offer convenience and efficacy. This trend is reflected in the market, where the demand for softgel capsules is projected to grow at a CAGR of approximately 8% over the next five years. Consumers are increasingly seeking products that support their health goals, such as immune support and overall well-being, which is propelling the softgel capsule market forward. Furthermore, educational campaigns and health initiatives by governments and organizations are likely to enhance consumer knowledge about the benefits of supplements, further stimulating market growth.

Expansion of Retail Channels

The softgel capsule market in South America is benefiting from the expansion of retail channels, which enhances product accessibility for consumers. Traditional brick-and-mortar stores, alongside online platforms, are increasingly stocking a variety of softgel products. This diversification in retail options is crucial, as it allows consumers to easily find and purchase their preferred supplements. Recent data indicates that the retail sector for dietary supplements in South America has seen a growth of approximately 12% in the last year, with softgel capsules representing a significant portion of this increase. The rise of health-focused retail chains and pharmacies is also contributing to the visibility of softgel capsules, making them more appealing to health-conscious consumers.

Regulatory Support for Nutraceuticals

Regulatory support for nutraceuticals is emerging as a key driver for the softgel capsule market in South America. Governments are increasingly recognizing the importance of dietary supplements in promoting public health, leading to more favorable regulations and guidelines. This supportive regulatory environment is likely to encourage investment in the softgel capsule sector, as companies seek to develop and market innovative products. Recent policy changes have streamlined the approval process for new supplements, which could potentially lead to a wider variety of softgel products entering the market. As a result, the industry may experience accelerated growth, with projections indicating a potential increase in market size by 20% over the next five years.

Rising Popularity of Herbal Supplements

The softgel capsule market is witnessing a surge in the popularity of herbal supplements, which is significantly influencing consumer preferences in South America. As more individuals seek natural alternatives to synthetic products, herbal softgel capsules are becoming increasingly favored. This trend is supported by a growing body of research highlighting the health benefits of various herbs, which is likely to drive demand. Recent statistics suggest that the herbal supplement segment is expected to grow by approximately 15% annually, with softgel formulations capturing a substantial share of this market. The appeal of herbal products, combined with the convenience of softgel delivery, positions this segment for robust growth in the coming years.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are playing a pivotal role in the softgel capsule market in South America. Innovations such as improved encapsulation techniques and the use of high-quality raw materials are enhancing the efficiency and quality of softgel production. These advancements not only reduce production costs but also improve the bioavailability of the nutrients contained within the capsules. As a result, manufacturers are able to offer more effective products, which is likely to attract a broader consumer base. The market is projected to see a growth rate of around 10% in the next few years, driven by these technological improvements that enable the production of specialized formulations tailored to consumer needs.

Leave a Comment