Rising Surgical Procedures

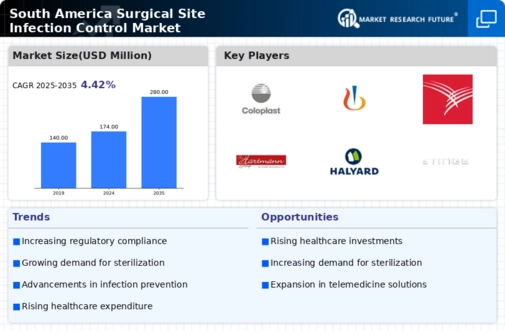

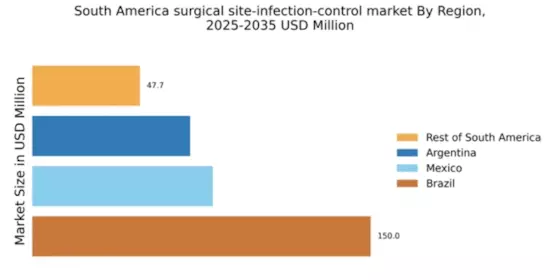

The increasing number of surgical procedures in South America is a primary driver for the surgical site-infection-control market. As healthcare facilities expand their surgical offerings, the demand for effective infection control measures intensifies. In 2025, it is estimated that surgical procedures will rise by approximately 10% across the region, leading to a heightened focus on preventing surgical site infections. This trend is particularly evident in countries like Brazil and Argentina, where healthcare systems are modernizing and expanding. The surgical site-infection-control market must adapt to this growing demand by providing innovative solutions that ensure patient safety and reduce infection rates. Enhanced surgical protocols and the adoption of advanced sterilization techniques are likely to play a crucial role in addressing these challenges.

Regulatory Compliance and Standards

The surgical site-infection-control market is being shaped by stringent regulatory compliance and standards set by health authorities in South America. Governments are increasingly implementing guidelines to ensure that healthcare facilities adhere to best practices in infection prevention. Compliance with these regulations is essential for hospitals to maintain accreditation and avoid penalties. As a result, there is a growing demand for products and services that help healthcare providers meet these standards. The market is projected to grow by 7% as facilities invest in training, equipment, and protocols to comply with regulatory requirements. This trend underscores the importance of maintaining high standards in surgical care and the role of infection control in achieving these objectives.

Growing Awareness of Infection Control

There is a notable increase in awareness regarding infection control among healthcare professionals and patients in South America. This heightened consciousness is driving the surgical site-infection-control market as stakeholders recognize the importance of preventing infections during surgical procedures. Educational initiatives and training programs are being implemented to inform medical staff about best practices in infection prevention. As a result, hospitals are investing more in infection control technologies and protocols. The market is projected to grow by 8% annually as healthcare providers prioritize patient safety and quality of care. This trend indicates a shift towards a more proactive approach in managing surgical site infections, ultimately benefiting both patients and healthcare systems.

Technological Innovations in Infection Control

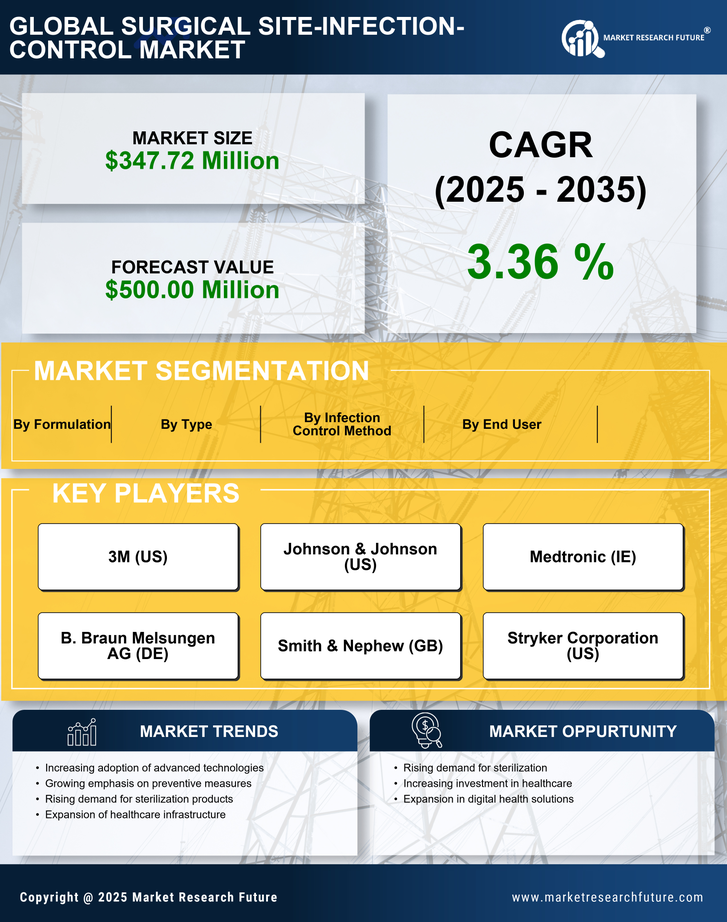

Technological advancements are significantly influencing the surgical site-infection-control market in South America. Innovations such as advanced sterilization equipment, antimicrobial coatings, and real-time monitoring systems are becoming increasingly prevalent. These technologies not only enhance the effectiveness of infection control measures but also streamline surgical workflows. The market for these technologies is expected to reach $500 million by 2026, reflecting a compound annual growth rate of 12%. As healthcare facilities seek to improve patient outcomes and reduce infection rates, the adoption of these innovative solutions is likely to accelerate. Furthermore, the integration of artificial intelligence and machine learning in infection control practices may provide valuable insights for healthcare providers, further driving market growth.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure across South America is a significant driver for the surgical site-infection-control market. Governments and private entities are allocating substantial funds to enhance healthcare facilities, which includes upgrading surgical units and infection control measures. In 2025, healthcare spending in the region is expected to increase by 15%, leading to improved resources for infection prevention. This influx of capital allows hospitals to acquire advanced technologies and implement comprehensive infection control programs. As healthcare systems evolve, the surgical site-infection-control market is likely to benefit from this trend, as facilities prioritize patient safety and strive to reduce the incidence of surgical site infections.