Government Initiatives and Support

The South Korean government plays a pivotal role in fostering the growth of the big data market through various initiatives and support programs. By investing in infrastructure and promoting research and development, the government aims to position the nation as a leader in data innovation. Initiatives such as the establishment of data centers and funding for startups in the big data sector are indicative of this commitment. Furthermore, the government's focus on creating a regulatory framework that encourages data sharing and collaboration among industries enhances the overall ecosystem. This proactive approach is expected to contribute to a projected increase in the big data market's value, potentially reaching $5 billion by 2027, thus solidifying the industry's foundation.

Growing Importance of Data Governance

In the evolving landscape of the big data market, the emphasis on data governance has become increasingly pronounced in South Korea. Organizations are recognizing the necessity of establishing robust data management frameworks to ensure data quality, compliance, and security. This focus on governance is driven by the need to mitigate risks associated with data breaches and regulatory non-compliance. As companies invest in data governance solutions, the market is likely to witness a significant uptick in demand for tools and services that facilitate effective data management. It is projected that the data governance segment within the big data market will grow by approximately 20% annually, reflecting the critical role of governance in shaping data strategies.

Expansion of IoT Devices and Connectivity

The proliferation of Internet of Things (IoT) devices in South Korea significantly impacts the big data market. With an increasing number of connected devices generating vast amounts of data, organizations are compelled to adopt advanced analytics solutions to harness this information effectively. The integration of IoT technology across sectors such as healthcare, manufacturing, and transportation creates a rich data environment that fuels insights and innovation. As of 2025, it is estimated that the number of IoT devices in South Korea will exceed 30 million, further amplifying the demand for big data analytics. This expansion not only enhances operational capabilities but also drives the growth of the big data market, as businesses seek to capitalize on the insights derived from IoT-generated data.

Advancements in Cloud Computing Technologies

The big data market in South Korea is significantly influenced by advancements in cloud computing technologies. The shift towards cloud-based solutions enables organizations to store, process, and analyze large volumes of data with greater efficiency and flexibility. This transition is particularly beneficial for small and medium-sized enterprises (SMEs) that may lack the resources for on-premises infrastructure. As cloud adoption continues to rise, it is anticipated that the big data market will experience accelerated growth, with cloud-based analytics solutions becoming increasingly prevalent. By 2026, the cloud segment of the big data market is expected to account for over 40% of the total market share, underscoring the transformative impact of cloud technologies on data analytics.

Rising Demand for Data-Driven Decision Making

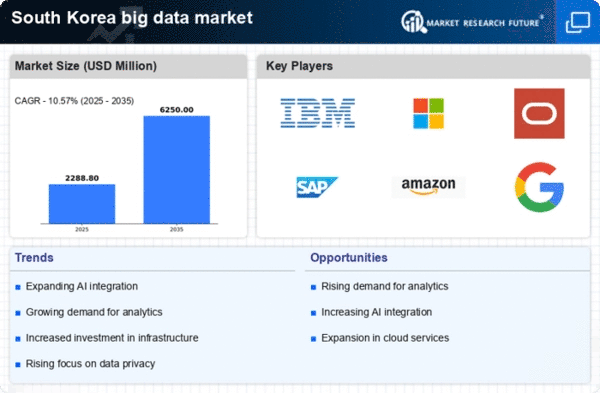

The big data market in South Korea experiences a notable surge in demand for data-driven decision making across various sectors. Organizations increasingly recognize the value of leveraging data analytics to enhance operational efficiency and drive strategic initiatives. This trend is particularly evident in industries such as finance and retail, where data insights can lead to improved customer experiences and optimized resource allocation. According to recent estimates, the market is projected to grow at a CAGR of approximately 15% over the next five years, indicating a robust appetite for data solutions. As businesses strive to remain competitive, the integration of big data analytics into their decision-making processes becomes essential, thereby propelling the growth of the big data market.