Increased Healthcare Expenditure

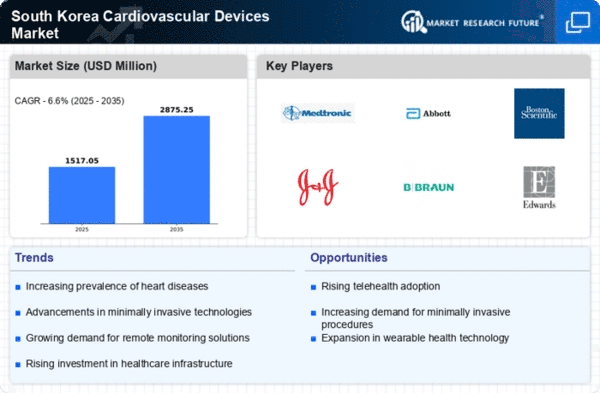

The rising healthcare expenditure in South Korea is a significant driver for the cardiovascular devices market. With the government and private sectors investing heavily in healthcare infrastructure, the availability of advanced medical devices is improving. In 2025, healthcare spending is projected to reach approximately $200 billion, with a substantial portion allocated to cardiovascular care. This increase in funding allows for the procurement of state-of-the-art cardiovascular devices, which are essential for effective diagnosis and treatment. Moreover, as the population ages, the demand for cardiovascular interventions is expected to rise, further propelling market growth. The cardiovascular devices market is likely to benefit from this trend, as healthcare providers seek to enhance their service offerings and improve patient care.

Expansion of Healthcare Facilities

The expansion of healthcare facilities across South Korea is a critical driver for the cardiovascular devices market. As new hospitals and specialized clinics are established, the demand for advanced cardiovascular devices is likely to increase. The South Korean government actively promotes the development of healthcare infrastructure, with plans to invest over $10 billion in the sector by 2026. This investment is expected to enhance access to quality cardiovascular care, thereby driving the need for various medical devices. Additionally, the establishment of specialized cardiovascular centers is likely to improve patient outcomes and increase the utilization of advanced devices. Consequently, the cardiovascular devices market is poised for growth as healthcare facilities expand and modernize.

Growing Awareness of Preventive Healthcare

There is a notable increase in awareness regarding preventive healthcare measures among the South Korean population, which is positively impacting the cardiovascular devices market. Educational initiatives and public health campaigns have led to a greater understanding of cardiovascular health, encouraging individuals to seek regular check-ups and screenings. This shift towards preventive care is driving demand for diagnostic devices such as echocardiograms and Holter monitors. As more people become proactive about their cardiovascular health, the market for these devices is expected to expand. Furthermore, the emphasis on early detection and intervention may lead to increased sales of therapeutic devices, thereby enhancing the overall growth of the cardiovascular devices market.

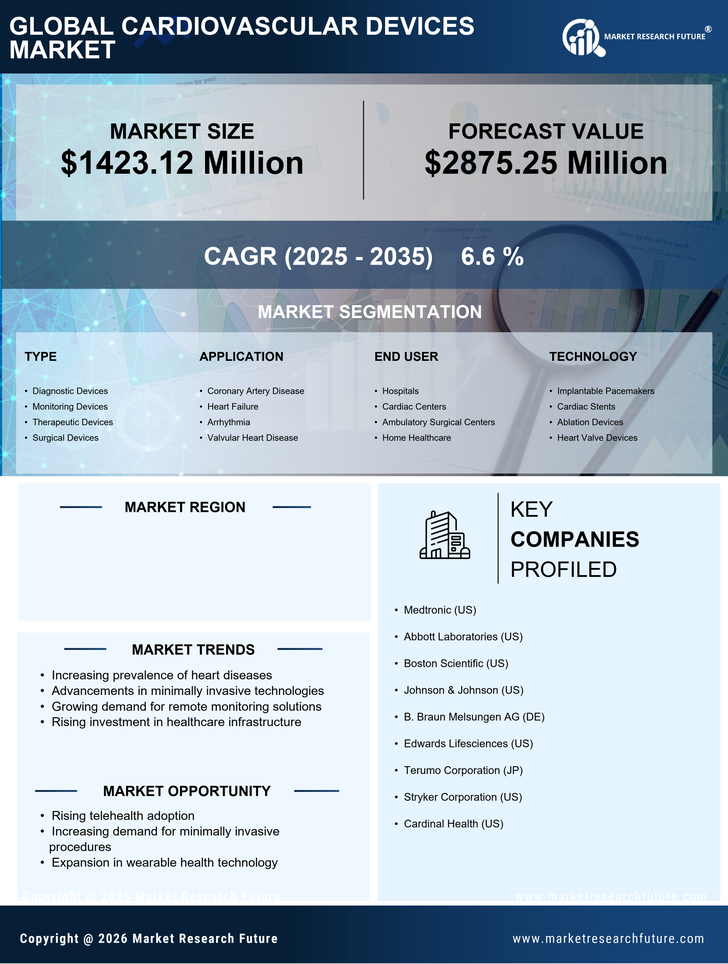

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases in South Korea is a primary driver for the cardiovascular devices market. According to recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in the country. This alarming trend necessitates the adoption of advanced cardiovascular devices for diagnosis and treatment. The demand for devices such as stents, pacemakers, and defibrillators is expected to rise as healthcare providers seek to improve patient outcomes. Furthermore, the South Korean government has initiated various health campaigns aimed at reducing cardiovascular disease risk factors, which may further stimulate market growth. As the population becomes more health-conscious, the cardiovascular devices market is likely to experience significant expansion in the coming years.

Technological Innovations in Medical Devices

Technological advancements play a crucial role in shaping the cardiovascular devices market. Innovations such as minimally invasive surgical techniques, advanced imaging technologies, and smart devices are transforming the landscape of cardiovascular care in South Korea. For instance, the introduction of bioresorbable stents has revolutionized treatment options, offering patients safer and more effective solutions. The market for cardiovascular devices is projected to grow at a CAGR of around 8% over the next five years, driven by these innovations. Additionally, the integration of artificial intelligence and machine learning in device design and patient monitoring systems is enhancing the efficiency and effectiveness of cardiovascular treatments. As these technologies continue to evolve, they are likely to attract more investments and drive the cardiovascular devices market forward.