Rising Awareness of Celiac Disease

The increasing awareness of celiac disease among the South Korean population is a notable driver for the gluten free-products market. As more individuals are diagnosed with this autoimmune disorder, the demand for gluten free options is likely to rise. Reports indicate that approximately 1 in 100 people globally are affected by celiac disease, and this awareness is gradually permeating South Korea. Consequently, consumers are actively seeking gluten free products to manage their health, thereby propelling market growth. The gluten free-products market is responding to this demand by expanding its offerings, ensuring that those with dietary restrictions have access to safe and suitable food options. This trend is expected to continue, as educational campaigns and healthcare initiatives further inform the public about the implications of gluten consumption.

Growing Trend of Clean Label Products

The clean label movement is significantly influencing the gluten free-products market in South Korea. Consumers are increasingly scrutinizing ingredient lists and seeking transparency in food production. This trend is characterized by a preference for products that are free from artificial additives and preservatives. As a result, many manufacturers in the gluten free-products market are reformulating their offerings to align with these consumer preferences. The clean label trend is not only about gluten free status but also encompasses a broader demand for wholesome, natural ingredients. This shift is likely to drive innovation and product development, as brands strive to meet the expectations of discerning consumers who prioritize health and quality.

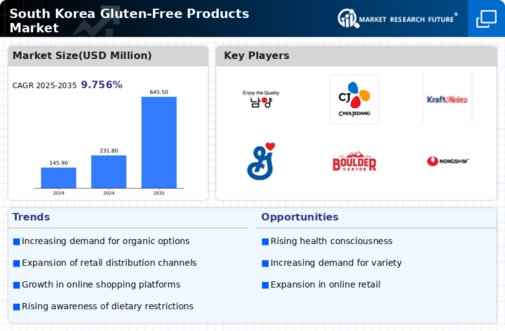

Increased Availability of Gluten Free Products

The gluten free-products market is experiencing a surge in availability across various retail channels in South Korea. Supermarkets, health food stores, and online platforms are increasingly stocking gluten free items, making them more accessible to consumers. Data suggests that the retail value of gluten free products in South Korea has seen a growth of approximately 15% annually, reflecting a shift in consumer purchasing behavior. This increased availability not only caters to those with dietary restrictions but also attracts health-conscious individuals who perceive gluten free products as healthier alternatives. The gluten free-products market is thus benefiting from enhanced distribution networks, which facilitate greater consumer access and encourage trial and adoption of gluten free offerings.

Influence of Dietary Trends and Lifestyle Changes

Dietary trends, such as the rise of plant-based diets and low-carb lifestyles, are impacting the gluten free-products market in South Korea. As consumers become more health-conscious, they are exploring various dietary options that align with their wellness goals. The gluten free-products market is witnessing a convergence of these trends, as many gluten free products are also suitable for those following vegan or low-carb diets. This intersection of dietary preferences is likely to expand the consumer base for gluten free offerings, as individuals seek versatile products that cater to multiple dietary needs. The market is thus positioned to capitalize on these lifestyle changes, potentially leading to increased sales and product diversification.

Support from Health Professionals and Nutritionists

The endorsement of gluten free diets by health professionals and nutritionists is a crucial driver for the gluten free-products market in South Korea. As more healthcare providers recognize the benefits of gluten free diets for individuals with gluten sensitivities or other related health issues, they are recommending gluten free options to their patients. This professional support is likely to enhance consumer confidence in gluten free products, leading to increased demand. The gluten free-products market is responding by ensuring that their offerings meet the nutritional needs highlighted by health experts. This collaboration between the medical community and the food industry may foster a more informed consumer base, ultimately driving growth in the gluten free-products market.