Growth in Electric Vehicle Adoption

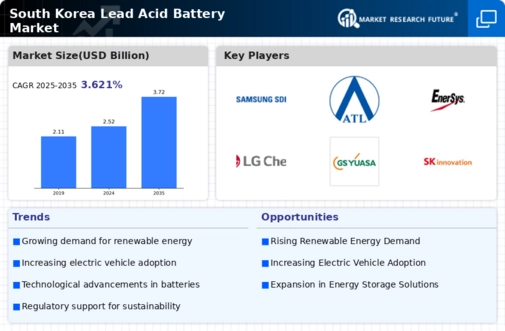

The lead acid-battery market is likely to benefit from the increasing adoption of electric vehicles (EVs) in South Korea. As the government implements policies to promote EV usage, the demand for batteries, including lead acid variants, is expected to rise. In 2025, the number of electric vehicles on South Korean roads is anticipated to reach 1 million units, creating a substantial market for batteries. Lead acid batteries, known for their reliability and affordability, are often utilized in hybrid vehicles and as auxiliary power sources in fully electric models. This growth in the automotive sector is a significant driver for the lead acid-battery market.

Infrastructure Development Initiatives

Infrastructure development initiatives in South Korea are contributing to the expansion of the lead acid-battery market. The government has allocated substantial funds for upgrading transportation and energy infrastructure, which includes the installation of backup power systems. Lead acid batteries are commonly used in uninterruptible power supplies (UPS) and backup systems for critical infrastructure, such as hospitals and data centers. In 2025, the infrastructure investment is projected to exceed $30 billion, creating a robust demand for lead acid batteries. This trend underscores the essential role of lead acid batteries in supporting the country's infrastructure resilience.

Rising Demand for Renewable Energy Storage

The Lead Acid Battery Market in South Korea is experiencing a notable surge in demand due to the increasing reliance on renewable energy sources. As the country aims to enhance its energy independence, the integration of solar and wind energy systems has become more prevalent. Lead acid batteries serve as a cost-effective solution for energy storage, enabling the efficient management of energy supply and demand. In 2025, the market for energy storage systems is projected to grow by approximately 15%, with lead acid batteries playing a crucial role in this transition. This trend indicates a shift towards sustainable energy practices, thereby bolstering the lead acid-battery market.

Increased Focus on Recycling and Circular Economy

The lead acid-battery market is witnessing a shift towards recycling and the circular economy in South Korea. With the growing awareness of environmental issues, there is a concerted effort to promote battery recycling programs. Lead acid batteries are among the most recycled products globally, with a recycling rate of over 95%. This focus on sustainability not only reduces waste but also provides a steady supply of raw materials for new batteries. In 2025, the recycling market for lead acid batteries is expected to grow by 10%, further enhancing the lead acid-battery market's appeal as an environmentally friendly option.

Technological Innovations in Battery Manufacturing

Technological innovations in battery manufacturing are poised to impact the lead acid-battery market positively. Advances in production techniques and materials are enhancing the performance and lifespan of lead acid batteries. Innovations such as improved grid designs and additives are leading to batteries that are lighter, more efficient, and have a longer cycle life. In 2025, the market is expected to see a 12% increase in the adoption of advanced lead acid batteries, driven by these technological improvements. This evolution in manufacturing processes is likely to strengthen the competitive position of lead acid batteries in various applications.