Rising Healthcare Costs

The medical billing-outsourcing market in South Korea is experiencing growth due to the escalating costs associated with healthcare services. As healthcare providers face increasing operational expenses, outsourcing billing functions appears to be a viable solution to enhance financial efficiency. Reports indicate that healthcare expenditures in South Korea have risen by approximately 7% annually, prompting organizations to seek cost-effective alternatives. By outsourcing billing processes, providers can focus on core medical services while reducing overhead costs. This trend is likely to continue as the demand for high-quality healthcare services increases, thereby driving the medical billing-outsourcing market.

Growing Emphasis on Patient Experience

The medical billing-outsourcing market is also influenced by the growing emphasis on enhancing patient experience. Healthcare providers in South Korea are increasingly recognizing that efficient billing processes contribute to overall patient satisfaction. By outsourcing billing functions, providers can ensure that patients receive clear and timely billing information, which can reduce confusion and improve trust. This focus on patient experience is expected to drive the medical billing-outsourcing market, as providers aim to create a seamless experience for patients while maintaining operational efficiency.

Focus on Compliance and Risk Management

The medical billing-outsourcing market is increasingly driven by the need for compliance with regulatory standards and risk management. South Korean healthcare providers are under pressure to adhere to stringent regulations, which can be complex and time-consuming. Outsourcing billing functions allows providers to leverage the expertise of specialized firms that are well-versed in compliance requirements. This focus on risk management is crucial, as non-compliance can lead to significant financial penalties. As such, the medical billing-outsourcing market is likely to expand as more providers seek to mitigate risks associated with billing and coding errors.

Increased Demand for Specialized Services

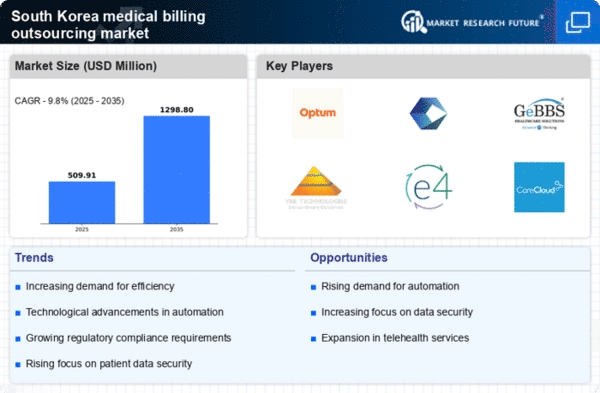

The medical billing-outsourcing market is witnessing a surge in demand for specialized billing services tailored to specific medical fields. As healthcare providers in South Korea expand their service offerings, the complexity of billing processes increases. This complexity necessitates expertise in various medical specialties, which outsourcing firms can provide. For instance, the rise of telemedicine and specialized clinics has led to a need for billing professionals who understand the nuances of these services. Consequently, the medical billing-outsourcing market is adapting to meet these specialized needs, potentially increasing its market share by 15% over the next few years.

Technological Advancements in Billing Solutions

Technological advancements are significantly influencing the medical billing-outsourcing market in South Korea. The integration of artificial intelligence and machine learning into billing processes is streamlining operations and reducing errors. These technologies enable outsourcing firms to process claims more efficiently, thereby improving revenue cycles for healthcare providers. As a result, the adoption of advanced billing solutions is expected to grow, with projections indicating a 20% increase in the use of automated billing systems by 2026. This trend not only enhances operational efficiency but also positions the medical billing-outsourcing market as a critical player in the healthcare ecosystem.