Focus on Patient-Centric Care

The medical imaging-software market is witnessing a shift towards patient-centric care, which is influencing software development and adoption. Healthcare providers in South Korea are increasingly prioritizing patient engagement and satisfaction, leading to the demand for imaging solutions that enhance the patient experience. Software that offers features such as easy access to imaging results and streamlined communication with healthcare providers is becoming essential. This focus on patient-centricity is likely to drive innovation in the medical imaging-software market, as companies strive to create solutions that not only improve diagnostic capabilities but also foster better patient-provider interactions.

Increased Healthcare Expenditure

South Korea's healthcare expenditure has been steadily increasing, which positively impacts the medical imaging-software market. The government has been investing heavily in healthcare infrastructure, aiming to enhance the quality of medical services. In 2025, healthcare spending is projected to reach approximately 9% of the GDP, reflecting a commitment to improving health outcomes. This increase in funding allows hospitals and clinics to upgrade their imaging technologies and software solutions. As a result, the medical imaging-software market is likely to benefit from this trend, as healthcare providers seek to adopt cutting-edge solutions that align with their enhanced capabilities.

Rising Incidence of Chronic Diseases

The prevalence of chronic diseases in South Korea is a significant driver for the medical imaging-software market. Conditions such as cardiovascular diseases, diabetes, and cancer are on the rise, necessitating advanced imaging solutions for early detection and management. According to recent health statistics, chronic diseases account for over 80% of healthcare expenditures in the country. This alarming trend compels healthcare facilities to invest in sophisticated imaging software that can facilitate timely diagnosis and treatment planning. Consequently, the medical imaging-software market is expected to witness substantial growth as healthcare providers seek to enhance their diagnostic capabilities and improve patient outcomes.

Growing Demand for Telemedicine Solutions

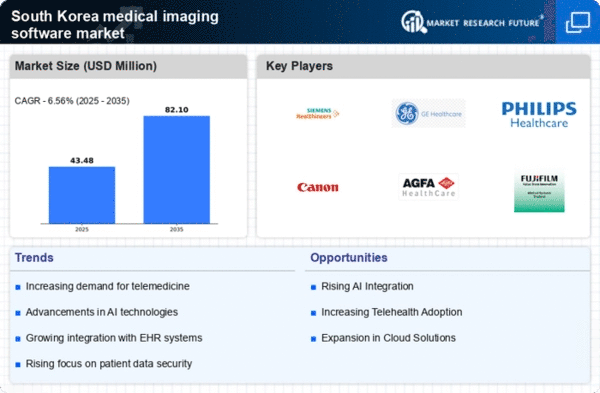

The medical imaging-software market is also being driven by the growing demand for telemedicine solutions in South Korea. As healthcare providers increasingly adopt remote consultation services, the need for efficient imaging software that can support telehealth initiatives becomes paramount. This shift towards telemedicine is likely to enhance patient access to diagnostic services, particularly in rural areas. The integration of imaging software with telehealth platforms can facilitate real-time sharing of imaging data, improving collaboration among healthcare professionals. This trend suggests a potential growth trajectory for the medical imaging-software market as it adapts to the evolving landscape of healthcare delivery.

Technological Advancements in Imaging Techniques

The medical imaging-software market in South Korea is experiencing a surge due to rapid technological advancements in imaging techniques. Innovations such as 3D imaging, MRI, and CT scans are becoming increasingly sophisticated, enhancing diagnostic accuracy. The integration of advanced algorithms and machine learning capabilities into imaging software is likely to improve image quality and reduce processing times. As a result, healthcare providers are more inclined to adopt these technologies, leading to a projected growth rate of approximately 10% annually in the medical imaging-software market. This trend indicates a strong demand for software solutions that can effectively manage and analyze complex imaging data, thereby driving market expansion.