Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure significantly impact the medical imaging-software market in South America. Various countries in the region are allocating funds to enhance healthcare facilities, which includes upgrading imaging technologies. For instance, initiatives to modernize hospitals and clinics often involve the procurement of advanced imaging software, thereby driving market growth. Additionally, public health campaigns focused on early disease detection further emphasize the need for effective imaging solutions. The financial support from government bodies is expected to bolster the adoption of medical imaging software, leading to a more robust healthcare system and improved patient care across South America.

Increase in Healthcare Expenditure

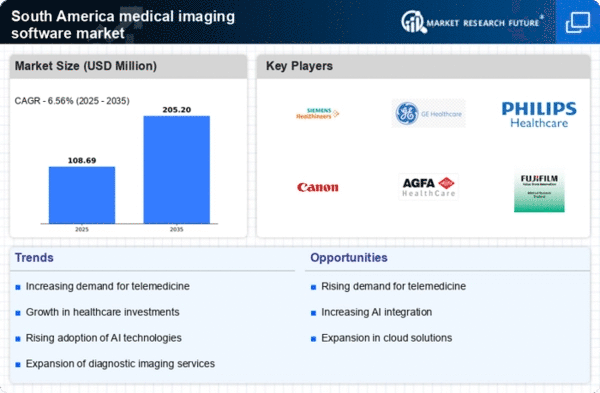

An upward trend in healthcare expenditure across South America is a significant driver for the medical imaging-software market. As governments and private sectors allocate more resources to healthcare, there is a corresponding increase in investments in advanced medical technologies, including imaging software. Reports indicate that healthcare spending in several South American countries is projected to rise by approximately 5-7% annually, reflecting a commitment to improving healthcare services. This increase in funding allows healthcare facilities to upgrade their imaging capabilities, thereby enhancing diagnostic accuracy and patient care. As a result, the medical imaging-software market is likely to benefit from this growing financial commitment to healthcare.

Rising Demand for Diagnostic Imaging

the South America market experiences a notable increase in demand for diagnostic imaging solutions. This trend is driven by the growing prevalence of chronic diseases, which necessitate advanced imaging techniques for accurate diagnosis and treatment planning. According to recent data, the incidence of conditions such as cardiovascular diseases and cancer is on the rise, prompting healthcare providers to invest in sophisticated imaging software. The market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the urgent need for enhanced diagnostic capabilities. As healthcare facilities strive to improve patient outcomes, the integration of advanced imaging software becomes essential, thereby propelling the medical imaging-software market forward.

Growing Focus on Preventive Healthcare

the market in South America is increasingly influenced by a growing focus on preventive healthcare. As awareness of the importance of early detection of diseases rises, healthcare providers are investing in imaging technologies that facilitate routine screenings and preventive measures. This shift towards preventive care is likely to drive demand for imaging software that supports various diagnostic procedures. Furthermore, the integration of imaging software with electronic health records (EHR) systems enhances the ability to track patient health over time, promoting proactive healthcare management. Consequently, this trend is expected to contribute positively to the growth trajectory of the medical imaging-software market.

Technological Advancements in Imaging Software

Technological innovations play a pivotal role in shaping the medical imaging-software market in South America. The introduction of cutting-edge technologies, such as 3D imaging and cloud-based solutions, enhances the efficiency and accuracy of diagnostic processes. These advancements not only streamline workflows but also facilitate remote access to imaging data, which is particularly beneficial in rural areas with limited access to healthcare facilities. The market is witnessing a shift towards software that incorporates artificial intelligence and machine learning algorithms, which can significantly improve image analysis and interpretation. As a result, healthcare providers are increasingly adopting these advanced solutions, contributing to the overall growth of the medical imaging-software market.