Rising Awareness of Preventive Healthcare

There is a notable increase in awareness regarding preventive healthcare in South America, which is positively influencing the cardiac imaging-software market. As individuals become more health-conscious, there is a growing emphasis on regular health check-ups and early detection of potential cardiac issues. This shift in mindset is prompting healthcare providers to invest in advanced imaging technologies that facilitate preventive measures. The market is expected to witness a growth trajectory of approximately 6% over the next few years, as more patients seek preventive screenings. Furthermore, educational campaigns aimed at promoting heart health are likely to contribute to the increased utilization of cardiac imaging software, thereby enhancing its market presence in the region.

Growing Investment in Healthcare Infrastructure

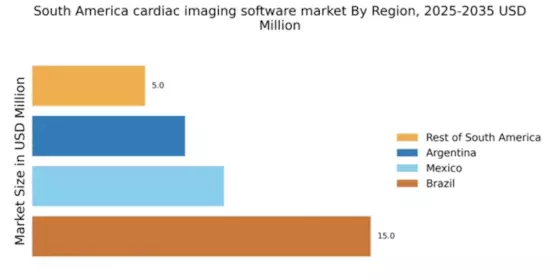

the cardiac imaging software market in South America is benefiting from growing investments in healthcare infrastructure. Governments and private entities are increasingly allocating funds to enhance healthcare facilities, particularly in urban areas. This investment is aimed at modernizing medical equipment and integrating advanced technologies, including cardiac imaging software. As a result, hospitals and clinics are better equipped to provide high-quality cardiac care. The market is projected to expand as more healthcare facilities adopt state-of-the-art imaging solutions, with an expected growth rate of 7% annually. Additionally, the establishment of specialized cardiac centers is likely to further drive the demand for sophisticated imaging software, thereby enhancing the overall landscape of cardiac care in the region.

Increasing Prevalence of Cardiovascular Diseases

The rising prevalence of cardiovascular diseases in South America is a critical driver for the cardiac imaging-software market. According to health statistics, cardiovascular diseases account for nearly 30% of all deaths in the region, prompting healthcare systems to prioritize early diagnosis and intervention. This alarming trend has led to an increased demand for advanced imaging solutions that can provide detailed insights into cardiac health. As healthcare providers seek to improve patient care, investments in cardiac imaging software are expected to rise significantly. The market is anticipated to reach a valuation of over $500 million by 2027, reflecting the urgent need for effective diagnostic tools in combating cardiovascular diseases. Consequently, the cardiac imaging-software market is positioned for substantial growth in response to this pressing health challenge.

Technological Advancements in Imaging Techniques

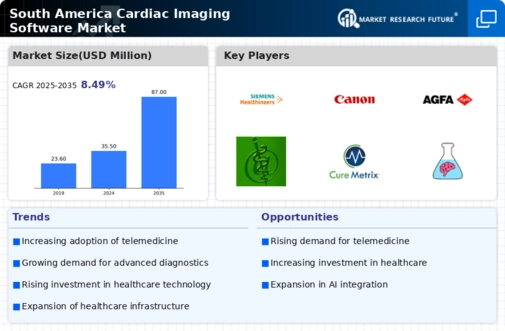

the cardiac imaging software market in South America is experiencing a surge due to rapid technological advancements in imaging techniques. Innovations such as 3D imaging, enhanced resolution, and real-time imaging capabilities are transforming diagnostic processes. These advancements not only improve the accuracy of cardiac assessments but also facilitate earlier detection of cardiovascular diseases. As a result, healthcare providers are increasingly adopting sophisticated imaging software to enhance patient outcomes. The market is projected to grow at a CAGR of approximately 8% over the next five years, driven by the need for more precise diagnostic tools. Furthermore, the integration of advanced imaging modalities with existing software solutions is likely to create new opportunities for vendors in the cardiac imaging-software market.

Collaboration Between Technology Firms and Healthcare Providers

The cardiac imaging-software market is witnessing a trend of collaboration between technology firms and healthcare providers in South America. These partnerships aim to develop tailored imaging solutions that meet the specific needs of healthcare facilities. By leveraging technological expertise, software developers can create innovative applications that enhance the functionality and usability of cardiac imaging tools. This collaborative approach is expected to drive market growth, as customized solutions are more likely to be adopted by healthcare providers. The market could see an increase in investment, with projections indicating a potential rise of 5% in software adoption rates over the next few years. Such collaborations not only improve the quality of cardiac care but also foster a more integrated healthcare ecosystem.