Increased Healthcare Expenditure

Rising healthcare expenditure in the US significantly drives the cardiac imaging-software market.. With healthcare spending projected to reach over $4 trillion by 2025, there is a growing emphasis on investing in advanced medical technologies. This financial commitment allows healthcare facilities to acquire state-of-the-art imaging software that enhances diagnostic accuracy and improves patient care. As hospitals and clinics allocate more resources to cardiac care, the demand for innovative imaging solutions is likely to surge. The cardiac imaging-software market stands to gain from this trend, as healthcare providers seek to optimize their operations and deliver high-quality services to patients.

Growing Demand for Remote Patient Monitoring

Increasing demand for remote patient monitoring solutions shapes the cardiac imaging-software market.. As healthcare systems evolve, there is a notable shift towards telemedicine and remote diagnostics, particularly for patients with chronic heart conditions. This trend is driven by the need for continuous monitoring and timely interventions, which can be facilitated by advanced imaging software. The cardiac imaging-software market is expected to expand as healthcare providers adopt these technologies to enhance patient engagement and improve outcomes. The market could see a growth rate of around 6% as more practitioners recognize the value of remote monitoring in managing cardiovascular health.

Rising Prevalence of Cardiovascular Diseases

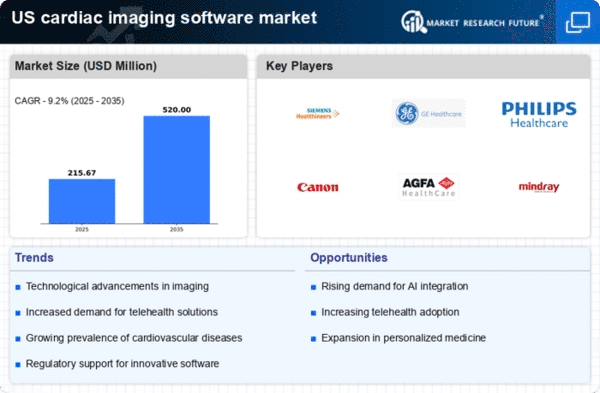

The increasing incidence of cardiovascular diseases in the US is a primary driver for the cardiac imaging-software market. According to the American Heart Association, cardiovascular diseases account for approximately 1 in every 4 deaths in the US. This alarming statistic underscores the urgent need for advanced diagnostic tools, including cardiac imaging software, to facilitate early detection and treatment. As healthcare providers seek to improve patient outcomes, the demand for sophisticated imaging solutions is likely to rise. Furthermore, The market is projected to grow at a CAGR of around 8% from 2024 to 2035, driven by the necessity for accurate and timely diagnosis of heart conditions.. The cardiac imaging-software market is positioned to play a crucial role in addressing this public health challenge..

Technological Advancements in Imaging Techniques

Technological innovations in imaging modalities, such as MRI, CT, and echocardiography, are significantly influencing the cardiac imaging-software market. Enhanced imaging techniques provide clearer and more detailed images, which are essential for accurate diagnosis and treatment planning. The integration of 3D imaging and real-time visualization capabilities has transformed how cardiologists assess heart conditions. As these technologies evolve, the demand for compatible software solutions that can process and analyze complex imaging data is expected to increase. The cardiac imaging-software market is anticipated to benefit from these advancements, with a projected growth rate of approximately 7% from 2024 to 2035.. This trend indicates a robust market environment driven by the need for cutting-edge imaging solutions.

Regulatory Support for Advanced Imaging Solutions

Regulatory bodies in the US are increasingly supporting the development and adoption of advanced imaging solutions, which is a key driver for the cardiac imaging-software market. Initiatives aimed at streamlining the approval process for innovative medical technologies encourage manufacturers to invest in research and development. This regulatory environment fosters competition and innovation, leading to the introduction of cutting-edge imaging software that meets the evolving needs of healthcare providers. As a result, The cardiac imaging-software market is likely to experience accelerated growth, with an estimated increase of 5% in market size from 2024 to 2035, driven by favorable regulatory conditions..